The biggest losers from the reporting season weren't the miners. They were the short-sellers as some of their biggest bearish bets failed to play out in what was a pretty upbeat profit environment.

However, these Doctors of Gloom may yet get their revenge given growing concerns that the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) is primed for a pull-back given the growing macro-economic risks and the strong run on the market.

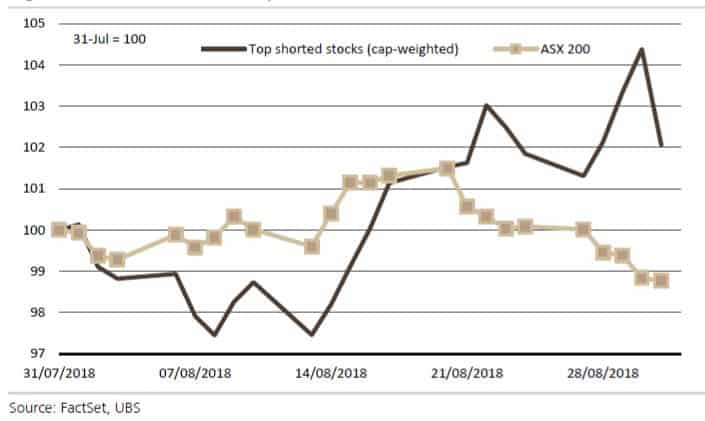

It's this strong run that is causing most short-sellers to be nursing losses with the most shorted stocks on the top 200 index such as JB Hi-Fi Limited (ASX: JBH), Metcash Limited (ASX: MTS) and Domino's Pizza Enterprises Ltd. (ASX: DMP) outperforming the broader market last month.

Short-sellers are those who sell borrowed stock in the hope of buying it back at a lower price later to profit from the difference. UBS noted that many of the hot favourite short-sold candidates have either posted better-than-expected results or have benefited from merger and acquisition (M&A) activity with TPG Telecom Ltd (ASX: TPM) the most obvious example.

Short on Profits: Performance of the most shorted stocks vs. the ASX 200

But the pain for short-sellers isn't confined to Australia. The longest bull-run on the US S&P 500 index has also left many hedge funds banking on a market rout in the red. Their favourite short-selling targets include the high-flying tech sector that includes Amazon.com, Inc., which just became the second US$1 trillion market cap company after Apple Inc.

These have been dangerous times to be short-seller.

However, not all short-bets on the ASX have been disasters. In fact, if we looked at the stocks that have seen a marked increase in short-selling interest right before the August reporting season, many have actually paid off for the bears.

Shares in fleet management group Eclipx Group Ltd (ASX: ECX) saw the biggest percentage increase in the amount of stock that was short-sold from the end of July to the middle of August when the reporting season ramped up.

The amount of its shares held by short-sellers jumped 2.5 percentage points over that two-week period and has continued to climb since, as its share price slumped 13% over the past month.

Other stocks that saw a more than 1% increase in short-interest from end the end of July to middle of August have also fallen into the red. These include plumbing solutions company Reliance Worldwide Corporation Ltd (ASX: RWC), milk products maker Bellamy's Australia Ltd (ASX: BAL) and crop protection products group Nufarm Limited (ASX: NUF).

The only exception is superannuation services company Netwealth Group Ltd (ASX: NWL) as its share price rallied 12% even as short-interest in the stock increased 1.7% to 6.2%.

Most of these stocks don't make it to the list of the most heavily shorted stocks. As I mentioned, many of those stocks have so far been outperforming.

However, if I am right and the ASX 200 starts retreating further from its more than 10-year high over the coming weeks, some of these losing bets may yet produce a winner.