One of the best performers on the local market on Monday has been the ResApp Health Ltd (ASX: RAP) share price.

At one stage the digital health company's shares were up as much as 41% at 27.5 cents. They have since pulled back a touch, but still sit 28% higher at 25 cents at the time of writing.

Why are ResApp's shares on fire?

This morning ResApp announced the top-line results from its Breathe Easy paediatric double-blind, prospective clinical study which uses machine learning algorithms to diagnose respiratory diseases from cough sounds recorded on a humble smartphone.

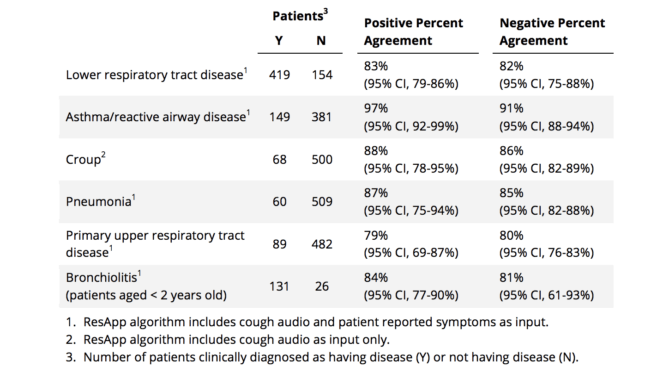

According to the release, independent statistical analyses of the Breathe Easy study, performed by Curtin University health researchers, confirmed that ResApp's algorithms accurately diagnose a broad range of childhood respiratory diseases when compared to clinical diagnoses.

The results are summarised on the table below:

Management believes these results are outstanding and in some cases (pneumonia and asthma) have exceeded their expectations. It feels this is a confirmation of ResApp's algorithms' robust performance and will allow it to provide key diagnostic products in an array of clinical settings.

One area where the company sees a major opportunity is telehealth. This is one of the fastest growing segments in healthcare and up to 50% of consultations are respiratory related.

Furthermore, the company's CEO and MD, Tony Keating, stated that "the successful completion of Breathe Easy also gives us additional data, experience and confidence as we finalise our US SMARTCOUGH-C-2 study."

The SMARTCOUGH-C-2 study is a key study that the company is currently working on and due for completion in the coming weeks. If this is a success it could be a major boost to its future prospects and of course its share price.

Should you invest?

I have been very impressed with the way the company has transformed itself over the last 12 months. The failure of the original SMARTCOUGH study was a major disappointment, but it does appear to have moved on from it now.

While I'm not ready to make an investment, I'll certainly be watching on with interest this month.

In the meantime, fellow medical technology shares such as Nanosonics Ltd (ASX: NAN) and Volpara Health Technologies Ltd (ASX: VHT) could be worth a look.