The Costa Group Holdings Ltd (ASX: CGC) share price has been amongst the worst performers on the market on Friday morning after the release of its full year results.

The horticulture company's shares are currently down 10% to $7.88 but were down as much as 21.5% to $6.86 at one stage. Though it is worth noting that even after today's decline its shares are up 51% since this time last year.

For the 12 months ended July 1, Costa achieved revenue of $1,002 million and transacted sales of $1,336 million. This was an increase of 10.2% and 13.3%, respectively, on FY 2017. EBITDA before SGARA and material items came in 30.9% higher at $150.8 million and NPAT before SGARA and material items rose 26.3% to $76.7 million.

Costa reported diluted earnings per share of 35.95 cents and declared a final dividend of 8.5 cents per share, bringing its full year dividend to 13.5 cents per share.

A strong performance from the company's key Produce segment supported its revenue and profit growth in FY 2018. The Produce segment delivered revenue growth of 7.3% to $843.3 million and EBITDA before SGARA growth of 23% to $119.3 million. As you can see below, avocado and citrus sales were the best performing categories and offset weakness in the berry and tomato categories. Avocado transacted sales are now in excess of $100 million per annum.

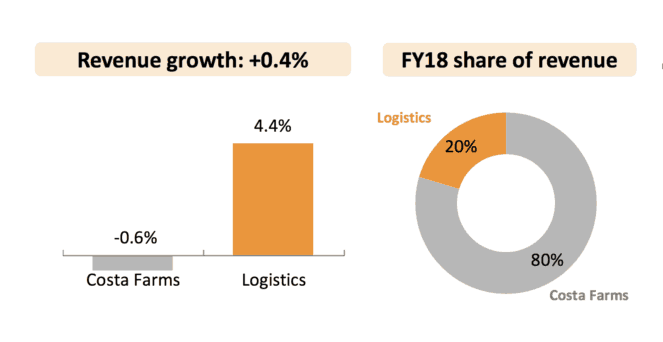

The Costa Farms & Logistics segment had a softer year and delivered a marginal increase in revenue to $152.2 million. Management advised that this was due to trading flows across the wholesale markets being dampened by lower availability of product from the core produce lines. However, due to improvements in its margin, EBITDA before SGARA was 32.5% higher at $5.7 million. As you can see below, the Logistics side of the segment has a solid year.

Finally, the International segment had a strong year thanks to the majority share acquisition of the African Blue business. Segment revenue was $74.4 million and EBITDA before SGARA was $25.8 million, up from $11.9 million and $14.2 million, respectively, a year earlier. As well as the Africa Blue acquisition, the company benefited from impressive sales growth into China driven by a strong blueberry harvest.

Due largely to the African Blue acquisition, Costa finished the year with net debt of $176.1 million, up from $84.2 million in FY 2017. This means its leverage is at 1.2x EBITDA before SGARA, which management believes is comfortable.

Outlook.

Management expects Costa's growth plans to continue to build capacity and market positioning both domestically and internationally. In FY 2019 it aims to deliver significant scale in mushrooms and avocados, which, combined with growth in tomatoes and berries, is expected to provide long term sustainable returns.

Based on its current trading conditions the company has forecast low double-digit growth in NPAT before SGARA in the year ahead.

Should you invest?

I've been a big fan of Costa for some time but its shares were always a little too expensive for me. But with them pulling back today, once the dust settles I think it could be a buying opportunity for investors willing to make a patient buy and hold investment.

In addition to Costa, other food shares such as Bega Cheese Ltd (ASX: BGA) and Freedom Foods Group Ltd (ASX: FNP) could be worth a look this week.