The Carsales.Com Ltd (ASX: CAR) share price was amongst the biggest movers on the market on Wednesday with a massive 11% gain to $16.25.

Investors were fighting to get hold of the car listings company's shares after it delivered a strong result for the 12 months ended June 30.

Carsales posted an adjusted net profit after tax of $131 million on revenue of $444 million. This was an increase of 10% and 19%, respectively, on the prior corresponding period. The company's reported net profit after tax, which excludes associate fair value revaluations, was up 69% year-on-year to $185 million.

Earnings per share came in at 76 cents and the board declared a fully franked final dividend of 23.7 cents per share, bringing its full year dividend to 44.2 cents per share.

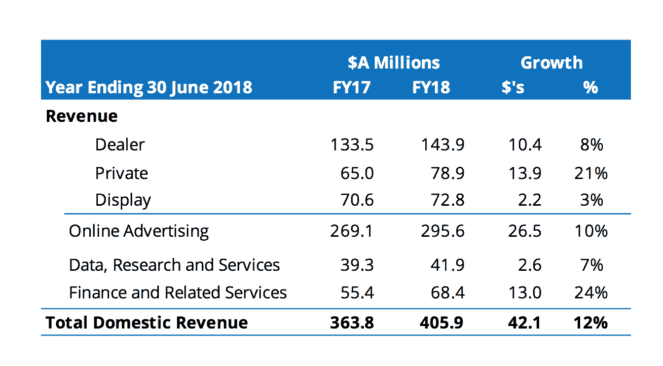

The majority of Carsales' revenue continues to be generated in the Australian market. Domestic revenue rose 12% in FY 2018 to $405.9 million. Strong growth in Private advertising was a key driver of the solid performance, as shown below.

It isn't hard to see why Carsales continues its growth in Australia. Its market leading website continues to outperform its nearest competitor on all key metrics. These include average daily unique audience, inventory size, average time spent on site, and most trusted place to buy and sell cars. The latter is based on a survey by research agency Nature.

Carsales' international businesses all performed well in FY 2018 and achieved revenue growth. The highlight was the South Korean-based SK Encar business which contributed $26.1 million in revenue and $13.8 million in EBITDA. The SK Encar business is responsible for over two-thirds of its international revenue.

Outlook.

Management expects the company's "domestic adjacent businesses to continue to build scale and complement this growth similar to FY18. We also expect our premium listing and depth products to continue to grow."

Internationally, it anticipates "continued strong local currency revenue and earnings growth in FY19 for Webmotors. In South Korea, we are expecting solid revenue and earnings growth in FY19 for SK Encar."

Should you invest?

I think Carsales is a quality business with a very attractive market leading position in Australia. If it is able to recreate this in international markets then it could provide it with significant growth for years to come.

This could make it worth holding onto its shares for the long-term along with fellow online listings companies such as REA Group Limited (ASX: REA) and SEEK Limited (ASX: SEK).