The WiseTech Global Ltd (ASX: WTC) share price was one of the best performers on the Australian share market on Wednesday. The logistics platform provider's shares finished the day a remarkable 27% higher at $19.90 after the release of a strong result for FY 2018.

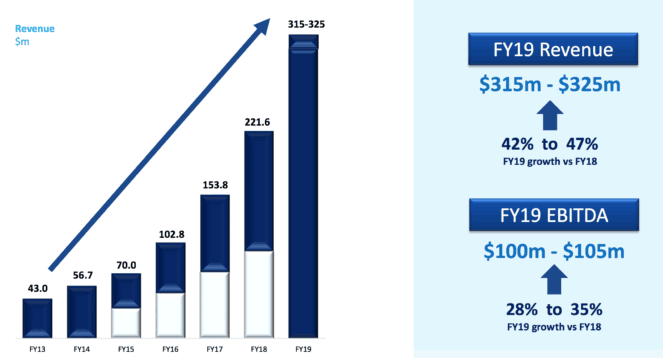

For the 12 months ended June 30, WiseTech Global posted total revenue of $221.6 million and net profit after tax of $40.8 million. This was an increase of 44% and 28%, respectively, on the prior corresponding period. Earnings per share was also 28% higher at 13.9 cents, allowing the board to declare a 1.65 cents per share final dividend.

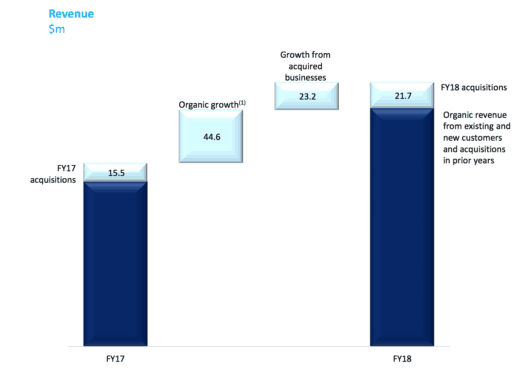

As you can see below, this growth was driven both organically and via acquisitions.

The key to its strong organic growth has been continued increased usage of its CargoWise One platform by existing customer organisations – adding transactions, users, new sites, and consolidating operations. In fact, every customer cohort from FY 2006 onwards has grown revenue each year since FY 2014. This means that the company is squeezing more dollars out of each customer group every year, no matter how long they have been customers.

Which isn't overly surprising given the development of the CargoWise One platform. The company added over 550 internally developed product enhancements and features in FY 2018 alone. It is this development and innovation which gives management the confidence to believe that the platform will be the operating system for global logistics in the future. It's already well on its way to achieving this with 34 of the top 50 global third-party logistics (3PL) companies and 24 of the top 25 global freight forwarders as customers. And given the fact that its attrition rate has been less than 1% over the last six years, it appears that these customers are more than satisfied with the platform.

Outlook.

Management expects the company's strong top and bottom line growth to continue in FY 2019, subject to currency movements. As shown below, it has provided guidance of revenue growth in the range of 42% to 47% and EBITDA growth in the range of 28% to 35%.

According to founder and CEO, Richard White, this guidance is based on: "The strong momentum and significant organic growth of the Group during FY18, the power of the CargoWise One platform, annual customer attrition rate of less than 1% and continued relentless investment in innovation and expansion across our global business."

Should you invest?

I am a huge fan of WiseTech Global and believe that its platform is going to become a staple of the logistics industry for decades to come.

In light of this, I feel it should prove to be a fantastic long-term buy and hold investment if you're prepared to be patient. The same applies for fellow tech stars Altium Limited (ASX: ALU) and Appen Ltd (ASX: APX).

However, at approximately 143x earnings, its shares certainly are trading on a nosebleed valuation. This may make them unsuitable for investors that don't have a high tolerance for risk and it could be worth holding out for a pullback in its share price.