The Data#3 Limited (ASX: DTL) share price has pushed 2% higher on Wednesday after the leading Australian IT services and solutions provider released its results for the 12 months ended June 30.

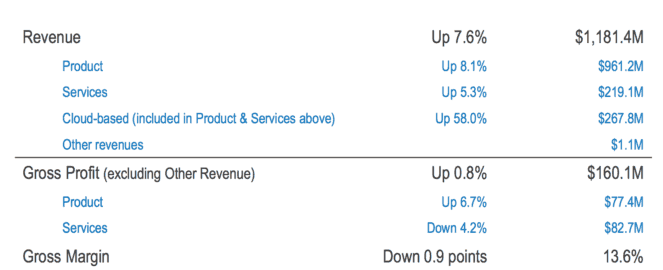

In FY 2018 Data#3 posted revenue of $1.2 billion and a net profit after tax of $14.1 million. This was an increase of 7.6% and a decline of 8.4%, respectively, on the prior corresponding period. Earnings per share came in lower at 9.14 cents, leading to its dividend being cut to 8.2 cents per share.

The solid revenue growth was driven by a positive performance from the company's core Product business and significant growth in Cloud-based revenues. This can be seen below.

While the core Product business still delivered solid profit growth, this was offset by declines in its Services business. Management has explained that lower than expected contributions from the Business Aspect and Discovery Technology acquisitions played a part in this.

Pleasingly, though, this was a major improvement from the first-half where profit after tax was down 52.5% on the prior corresponding period. The successful turnaround of its Business Aspect business played a role in this. It went from making a loss in the first half to being close to break even by the end of the second half.

Chief executive officer and managing director Laurence Baynham appeared to be happy with the company's second half result after the challenging first half caused by a number of one-off events, primarily in its services segment. However, Baynham did acknowledge his disappointment that the company fell short of its full year objective to improve on FY 2017 earnings.

But he does appear optimistic on the year ahead. When providing its outlook for FY 2019, he commented that:

"We see economic conditions in FY19 remaining steady, with a positive IT industry growth outlook. We continue to see digital technologies leading business transformation in both the commercial and public sectors. We remain well positioned to enable this transformation and to capture new business. Our overall financial goal remains to deliver earnings growth and improved returns to shareholders."

Should you invest?

With Data#3's shares up 2% to $1.63 today, it means they are changing hands at approximately 18x earnings. I don't think this is overly demanding if the company is able to build on its strong second half performance and deliver solid profit growth in FY 2019.

Another bonus for investors is that its shares currently provide a trailing fully franked 5% dividend despite its dividend cut.

As well as Data#3, I think information technology sector peers Hansen Technologies Limited (ASX: HSN) and Infomedia Limited (ASX: IFM) could be worth a look.