The Bapcor Ltd (ASX: BAP) share price has edged 2% lower after the leading provider of automotive aftermarket parts, accessories, equipment, and services released its full-year results for the 12 months ended June 30.

From its continuing operations Bapcor reported revenue growth of 22% to $1,236.7 million and pro forma net profit after tax growth of 31.6% to $86.5 million in FY 2018. Pro forma earnings per share came in at approximately 31 cents, up 27% on the prior corresponding period. This result was in line with its guidance and allowed the board to declare a fully franked final dividend of 8.5 cents per share, bringing its full-year dividend to 15.5 cents per share. This was an increase of 19.2% on last year's dividend.

Statutory net profit after tax, which includes its discontinued Contract Resources, TBS and Footwear businesses, rose 47.8% to $94.7 million.

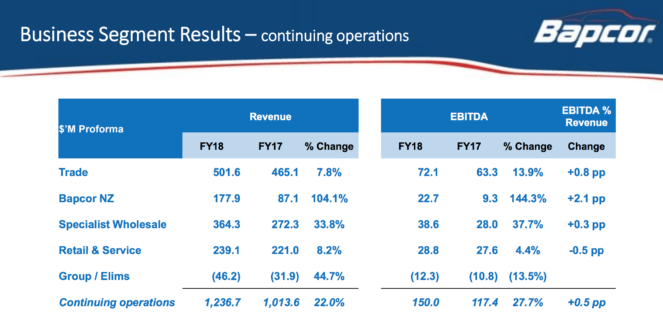

The strong result was driven by positive performances across all its businesses, as shown below.

The Burson Trade segment, which consists of Burson Auto Parts and Precision Automotive Equipment businesses, saw revenue increase 7.8% and EBITDA grow 13.9% thanks to the addition of 10 new stores and same store sales growth of 4.4%. Management advised that it has increased its store network target from 200 to 230 stores by 2023, up from 170 stores today.

The Bapcor New Zealand segment was a highlight in FY 2018 and increased revenue and EBITDA by 104.1% and 144.3%, respectively. This was due largely to the timing of the acquisition of the Hellaby's business and strong same store sales growth of 6.1% from its BNT trade business.

Bapcor's Specialist Wholesale segment grew revenue by 33.8% and EBITDA by 37.7% in FY 2018. This segment, which now comprises eleven business units – AAD, Bearing Wholesalers, Opposite Lock, Baxters, MTQ Engine Systems, Roadsafe, AADi, JAS Oceania, PAT, Diesel Distributors, and Federal Batteries, reported positive performances across all brands.

Finally, the Retail & Service segment saw revenue rise 9.2% and EBITDA climb 4.4% year-on-year. A key segment highlight in FY 2018 was the company owned Autobarn stores which delivered a 4.7% increase in same store sales. There are now 128 Autobarn stores operating, with management ultimately targeting a total of 200 stores.

Outlook.

According to the release, management expects continued revenue and profit growth in FY 2019. It believes that consensus predictions of EBITDA of approximately $170 million are reasonable, leading to an increase in net profit after tax of between 9% and 14% above FY 2018's pro forma result.

Should you invest?

I think that Bapcor is one of the highest quality retailers on the Australian share market and well worth considering as a buy and hold investment.

Based on today's share price decline and its pro forma earnings per share of 31 cents, its shares are trading at 22x earnings. While this is a premium over the market average, I feel its long runway for growth means that it is a reasonable price to pay for its shares given its current growth profile.

In addition to Bapcor, I think Supercheap Auto owner Super Retail Group Ltd (ASX: SUL) is another great option for investors along with fellow retail conglomerate Premier Investments Limited (ASX: PMV).