The ARB Corporation Limited (ASX: ARB) share price has edged lower on Wednesday following the release of the four-wheel drive vehicle accessories company's results for the 12 months ended June 30.

ARB reported a net profit after tax of $51 million on sales of $424 million in FY 2018, up 3.7% and 11.7%, respectively, on the prior corresponding period. Earnings per share came in at 64.3 cents for the year. ARB's profit result was impacted by an under provision for taxes in previous years expensed in the current year of $3 million. Adjusting for this one-off would mean profit after tax grew 9.9% to $54 million. Higher employee expense and materials costs were largely behind the slight narrowing of its margins.

The board declared a final dividend of 19.5 cents per share, which brought its full-year dividend to a total of 37 cents per share. This was up 8.8% on FY 2017's dividend and represents a payout ratio of 57.5%.

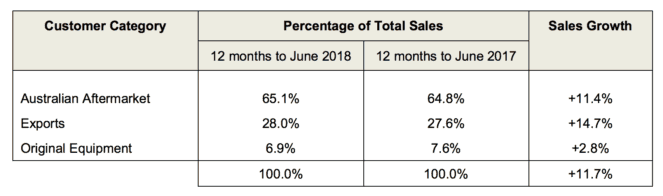

The key drivers of sales growth in FY 2018 were the company's Australian Aftermarket and Exports categories. As you can see below, sales grew strongly during the 12 months.

The key Australian Aftermarket category delivered above average sales growth in Queensland, New South Wales, Tasmania, South Australia, and Western Australia. Growth in Victoria was below average but was cycling off very high growth figures for the past five years. Whereas Northern Territory growth was below average due to capacity constraints.

The company added two new stores to its Australian network in FY 2018 and finished it with a total of 63 ARB stores, of which 25 are company owned. However, the new stores have only been open for a little time, which means they made no contribution to this year's result. A further three stores are expected to added to the network over the next 12 months. These stores will launch with the new ARB store format, which management says has been received well by customers. The new format is being progressively rolled out across relocated and existing stores.

Export sales grew by 14.7% in FY 2018 and now represent 28% of the company's sales. Management has advised that growth was achieved in export sales made from distribution centres in Australia, the USA, the Czech Republic, Thailand, and from the United Arab Emirates.

Management has noted that the 4WD market continues to grow in many parts of the world, making its Exports category a key focus for the company. It intends to make further investments in both infrastructure and marketing in order to capture this growth.

Sales to Original Equipment Manufacturers (OEM) grew by just 2.8% for the year. This soft growth was due to some OEM projects being delayed in the second half due to programme complications. But these projects are planned to commence shortly, which should result in better sales growth in FY 2019.

The company spent $9.5 million on research and development in FY 2018. Management continues to increase its R&D spending in line with company growth in order to maintain its long-term competitive advantage. And with a large number of new vehicle releases occurring, new products are being released into its factories on a weekly basis.

Outlook.

Management has warned that current economic conditions remain uncertain and could impact its business. In addition to this, it expects the severe droughts in eastern Australian states to affect its business to some extent.

However, it remains positive about the future due to the healthy demand for its products around the world and the long-term growth plans that it has in place.

No guidance was given for FY 2019, but management intends to provide a first-quarter trading update at its annual general meeting in October.

Should you invest?

With its shares trading at approximately 33x earnings, ARB looks fully valued in my opinion. However, if you're prepared to buy and hold its shares for an extended period of time then picking them up at these levels could still prove to be a good move due to the company's outstanding long-term growth potential.

Alternatively, you could look at Bapcor Ltd (ASX: BAP) and Super Retail Group Ltd (ASX: SUL) which both reported their results this week.