In its May report, the Chester High Conviction Fund said New Century Resources Ltd (ASX:NCZ) remains "the cheapest cash generator we can find."

This month, the company expects to restart production at the Century Zinc Mine in Queensland. Its aim is to become one of the top 10 zinc producers in the world and also in the lowest cost quartile globally.

In a presentation to the Sydney Mining Club, the ASX 300 listed company confirmed it was expecting to start generating cashflow this quarter as it transitioned from developer to producer.

From a valuation perspective, the company says it trades on an enterprise value to 2019 EBITDA ratio of 2.1 times, putting it as one of the cheapest zinc producers in the world. By comparison, Oz Minerals (ASX:OZL) trades on a 5.0 times ratio, with Western Areas (ASX:WSA) shares trading on a 4.6 times ratio.

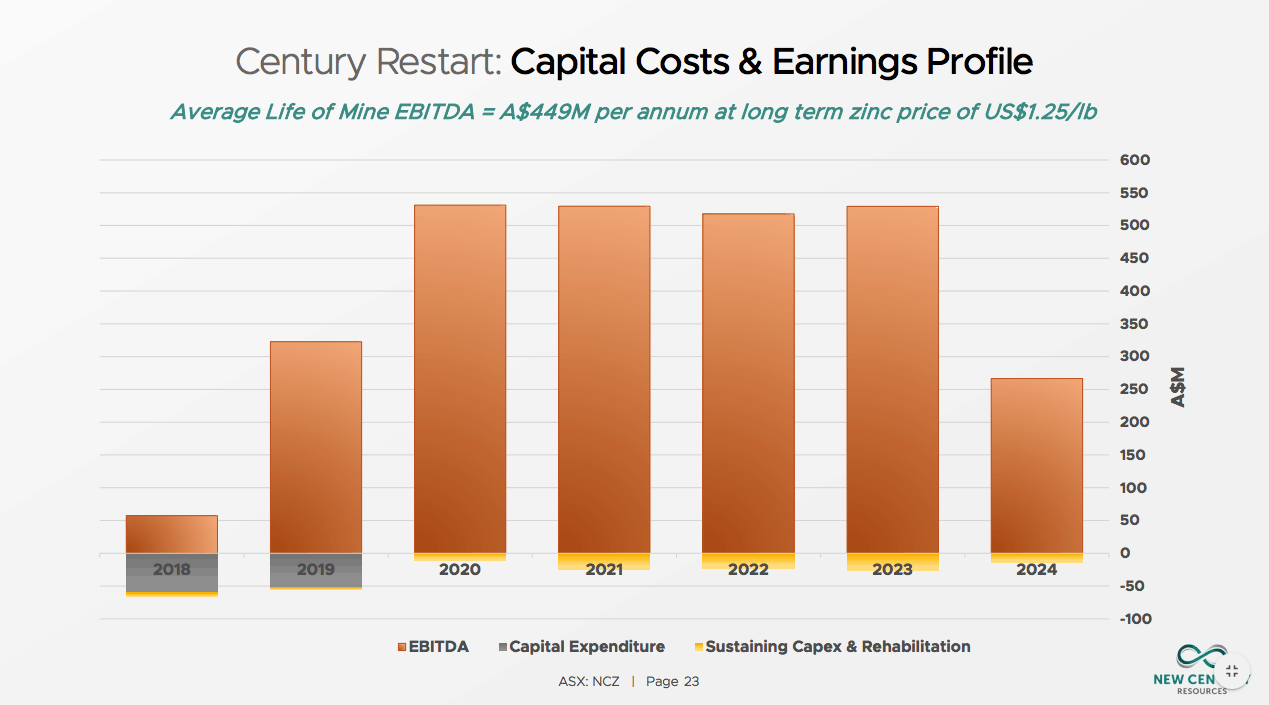

To emphasise its potential, the company showed how it can generate almost $450 million EBITDA per annum over the average life of the mine, which compares very favourably to the company's market cap of $610 million.

As of writing, the New Century share price is $1.185.

Source: Company presentation

Although New Century Resouces shares look dirt cheap, as with any investment, it comes with risks.

Although zinc is trading well above the mine's break even point today, you can bet your bottom dollar other zinc producers are working on adding to the world's supply, something that absent a commensurate increase in demand, will ultimately drive the zinc price lower.

Paringa Resources Ltd (ASX:PNL) is a new entrant into the Illinois coal basin. It is now fully funded to first production, expected imminently, in Q4 2018.

After that, Paringa expects significant ramp up in 2019 with full production from two initial units in 2020.

In their June 2018 quarterly update, the NovaPort Microcap Fund said a construction cost blowout saw Paringa raise further equity at a significant discount to the then prevailing share price.

The company expects to be cashflow positive in Q2 2019 and to generate $41 million EBITDA in 2020. This compares very favourably with its current market capitalisation of around $98 million.

Source: Company presentation

Paringa says it has a 25 year life of mine.

The Paringa Resources share price has fallen almost 40 per cent in 2018, currently trading at 21.5 cents.

As with all junior mining shares, this one is high risk, especially as it is subject to the vagaries of the coal price. But, if all goes to plan, it looks cheap.

Read more

- Top ASX stocks of the week: August 3rd 2018

- Here's how the rally in ASX tech stocks could have much further to run

- It might be one of the most heavily shorted ASX stocks, but one top performing fund manager still believes in Syrah Resources

Three more cheap ASX stocks

Combining countless hours of research with over 30 years of hands-on stock market investing experience, The Capital Club's founder Bruce Jackson has just published his definitive list of 3 Cheap and Good ASX Stocks for 2018.

The names of the three companies are revealed in a brand new investing report. But you will have to hurry, as these stocks are already on the move. Click here now to get this FREE report.