Remember the great infant formula boom of 2016 and 2017? Remember the rush of Chinese ex-pats buying Australian vitamins and sending them back to family, friends and assorted other customers?

Remember how China was going to underpin the continued growth of Australian food and other assorted agriculture?

Well, that's all true. But the dark horse, at least for those who haven't been paying attention to the data is something far more dear to many of our hearts: the humble Australian table wine.

Well, not so humble, actually, when you check out the data. And therein lies the great opportunity for Australian viticulture.

Check out these tables, courtesy of Wine Australia:

Source: Wine Australia

Check out those countries in the table at the top. Our top wine destination by value, by the length of the straight at Flemington, is China.

And it's growing at 55%.

Not only that, but on volume terms, it's closing on the UK fast, and is even money to take top spot by this time next year.

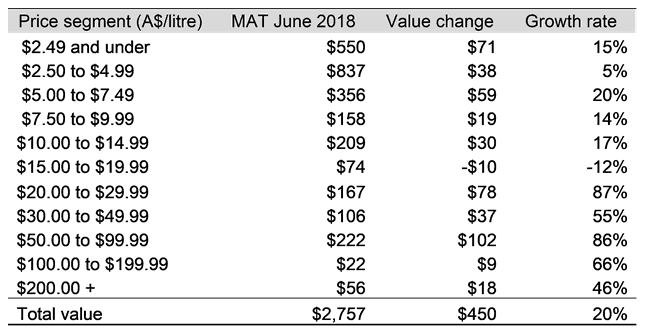

Now have a look at this one:

Source: Wine Australia

Get the picture? Australian export growth is driven by China. And the Chinese are demanding not the cheap plonk, but the top-shelf, I-hope-you-bought-the-platinum-Amex variety. The bean-counters at Penfolds owner, Treasury Wine Estates (ASX:TWE), should be happy!

All of the growth, materially speaking, is at the top end of the price curve. Yes, the lower price points are also growing, but check out the cumulative growth of the $20-plus wine. And the $50-plus segment.

China is now, and will remain for many years, key to Australia's economic prosperity. For now, it's true that iron ore is top of the pops. But keep a weather eye on the Australian wine industry, as well as the broader 'Made in Australia' theme, including tourism.

The future is very bright. And has a floral bouquet and notes of cigar and chocolate. And is paid for in Yuan.

I don't know the Mandarin word for 'Cheers', but I have a feeling I'll be learning it soon — and hearing it a lot in the years to come.