Praemium Ltd (ASX: PPS), the investment administration and platform provider, has announced that gross inflows of $760 million over the last quarter have driven its funds under administration (FUA) to $8.3 billion as at 30 June 2018.

This ranks in the top 5 best quarters for Praemium in terms of gross inflows both for its Australian business (third highest on record) and its international business (fourth highest on record).

It also means that Praemium had a record $3 billion gross inflow in FY 2018, 50% higher than the gross inflows it had last year.

No sign of stopping

Praemium's FUA growth has been driven by a number of factors including:

- New client wins with Morgan Stanley Wealth Management, CMC Markets and JB Were all signing up with Praemium over the last quarter

- Tailwinds in the superannuation and pension fund industries

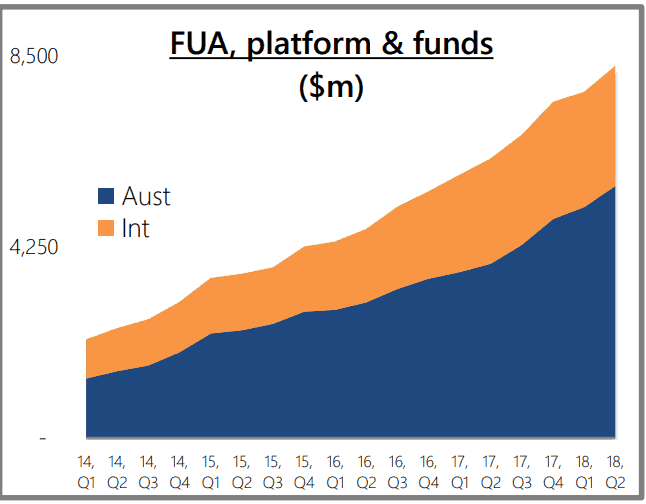

A look at the graph below which depicts Praemium's FUA since 2014 shows a relentless push upwards and there are no signs of that graph flattening any time soon, particularly when you consider that superannuation guarantee rates are set to increase over the next couple of years.

Interestingly enough as well, the international business as a percentage of Praemium's overall portfolio has increased over time and that could be an area of growth in the future.

Source: Praemium ASX announcement

Foolish Takeaway

The growth in retirement assets has spurred on Praemium and other service providers to the industry such as Hub24 Ltd (ASX: HUB) and Onevue Holdings Ltd (ASX: OVH).

That growth has not gone unnoticed as all three companies have seen their share prices run up 109%, 76% and 36% respectively over the last year.

These companies are priced for growth and so funds under administration will need to keep increasing rapidly to justify their share price.

For now, with industry tailwinds on their back, that looks likely to continue.

Praemium is not the only small cap that has performed really well recently. This FREE REPORT identifies a high margin small cap that has been identified by our team of experts as their number 1 medical technology pick.