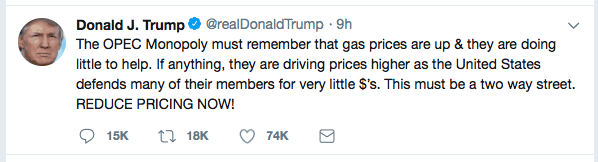

Not content with complaining that the terms of global trade for the U.S. are unfair, President Trump is now taking to digital soapbox Twitter to regularly complain that oil prices are too high.

This afternoon benchmarked brent oil futures are trading for US$77 a barrel of oil equivalent, with the oil price climbing steadily for much of the past year.

The oil price is rising mainly because the OPEC member group of oil-producing nations and Russia are colluding to manage supply in such a way that supports prices.

In the past the straight-talking president has described OPEC as a "cartel" and "total illegal monopoly" even suggesting that if a business existed like it in the U.S. "everyone would be thrown in jail".

It seems the President is upset at the higher prices as much of the U.S. electorate prefers cheaper petrol prices when it comes to filling up their gas-guzzling automobiles.

The demand to "reduce pricing now" may fall on deaf ears though as the U.S. and OPEC are more like historical enemies than friends, with the wild swings in oil prices a reflection of this reality.

Lower oil prices are not just a policy objective of President Trump, but the U.S. Congress more generally on a bipartisan basis, which is one reason why I remain bearish on the long-term direction of energy prices. The kicker being the potential for U.S. shale oil and new extraction technologies to keep lifting supply at lower marginal costs of production.

Even the Saudis themselves don't seem optimistic on the medium-term future of oil prices given they are preparing to auction off state-owned oil producer Saudi Aramco in what is being described as potentially the biggest IPO of all time.

As such investors in the likes of Santos Ltd (ASX: STO), Woodside Petroleum Limited (ASX: WPL) and Oil Search Limited (ASX: OSH) are likely to be in for a volatile ride given their leverage to the swings in oil prices.