One of the biggest IPOs of the year was due to hit the ASX boards at noon, but was postponed at the last minute due to a query by ASIC.

Prospa Group Limited (ASX: PGL) shares were due to commence trading after the small business lender successfully raised $146.5 million at $3.64 per share, giving Prospa a market capitalisation of $580 million.

But according to a last minute release, the joint lead managers and Prospa are "seeking to clarify queries raised by ASIC yesterday in relation to Prospa's small business loan terms, in the context of an industry wide review into financial services small business loan terms. Consequently the listing is expected to be postponed for approximately 48 hours."

What is Prospa?

Prospa is an online small business lender aiming to disrupt the banks by allowing businesses to apply for loans of up to $250,000 in under ten minutes, with fast approvals and funding usually within 24 hours.

According to its prospectus, as of February 28 Prospa was Australia's number one online small business lender with over $500 million in loan originations since its inception in 2012 and a net loan book of $200 million.

Why did it list on the ASX?

The offer raised $146.5 million, comprising a $100 million primary raise of which 60% will be used to fund the equity portion of the growing loan book and 40% will be used to fund investments in new products and geographies and provide working capital.

The remaining $46.5 million will allow existing shareholders an opportunity to realise part of their investment in the company.

Is the company growing?

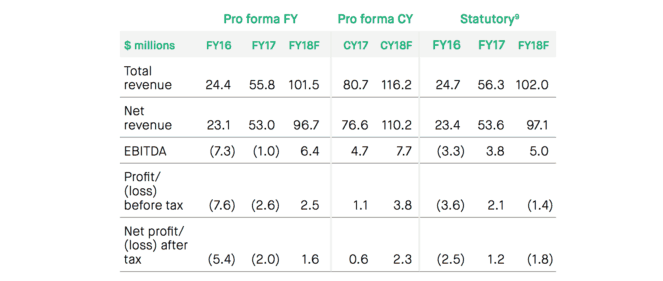

As you can see below, Prospa has been growing at an impressive rate.

Source: Prospa prospectus

Based on its forecasts for FY 2018, Prospa expects pro forma revenue growth of almost 82% in FY 2018 and a maiden net profit after tax of $1.6 million.

The company has advised that this revenue has been generated from all corners of the Australian economy. Key markets include building and trade, hospitality, professional services, and retail. Each accounts for roughly a fifth of its portfolio.

Should you invest?

Having an IPO postponed at the last minute is never a good look, so it will be interesting to see how the market reacts when it finally does come online.

But looking at the stats and forecasts of the company it is hard not to be impressed, especially given the outlook of traditional lenders such as Australia and New Zealand Banking Group (ASX: ANZ) and Commonwealth Bank of Australia (ASX: CBA).

I think it could be worth a closer look when it lists along with fellow fast-growing lender Money3 Corporation Limited (ASX: MNY).