- NetEase has an extremely strong business model and robust games pipeline. The company operates in an extremely consolidated sector and is perfectly positioned to profit from the secular growth in the gaming market in China.

- NetEase has strategic partnerships with Activision Blizzard, Mojang (AB) in addition to a great in-house development team. It has more diversified operations than ever and is no longer dependent on just a couple of major titles.

- NetEase has begun to develop a very strong E-Commerce business through its platforms Kaola and Yanxuan. These are still in the early stages of growth, yet the market is basically assigning no value to them.

BUY NetEase on the Pullback

NetEase is a Chinese tech company which is still unfamiliar to most in the West. This is unfortunate, as I believe NetEase is probably one of the greatest companies in the world. Its core operations revolve around video games and online advertising, though the company has also launched two E-commerce platforms, Kaola and Yanxuan which import high-end consumer goods, targeted at China's growing middle class. Finally, the company offers a range of online services and is even China's largest email provider, with over 850 million Chinese citizens using its email service.

The company is an entrenched player in the Chinese market and Ding Lei, its founder was the very first Chinese tech billionaire. What makes NetEase such a great company? Well firstly, the company has compounded its earnings at 30% annually in the last ten years. NetEase earns around 30 percent on equity while maintaining a pristine balance sheet. The company barely has debt and has actually been returning value to shareholders through periodic share repurchases and stock buybacks. I have personally owned the company's stock for the last 12 years and taken advantage of pullbacks in the market to up my stake as much as possible.

The Future Looks Bright

NetEase is fortunate enough to operate in an extremely favourable sector in one of the world's most video-game crazed markets. There are a number of fundamental reasons which explain the company's success and why the company has been such a great investment over the long run.

- NetEase has operating leverage: Most of the companies spend is the cost of developing new video games. Once a game is developed, there are basically no variable expenses which act as a burden on the bottom line. That means for NetEase, selling a million copies of a game costs basically the same amount as selling ten thousand copies.

Now you could argue that this is the same situation for all gaming companies. You would be correct in making that observation. The difference, however, is the fact that NetEase has direct access to 1.3 billion Chinese citizens, many of whom have only recently joined the middle-class. This is a massive advantage which almost no other company in the world has. NetEase is perfectly positioned to capture the Chinese middle class.

- Pricing Power: NetEase earns its money from customers through two different revenue streams, an item-based model and a time-based model. NetEase currently charges just RMB0.60 (US$0.10) for time-based games, which is still extremely cheap. The company is able to charge such low prices because it operates on such a large scale and has a massive amount of operating leverage. Over time though, as the Chinese middle classes' wealth increases, a minor increase in price will still impact the bottom line in a very positive way. The item-based model also gives NetEase the opportunity to increase the incremental spend per client, if there were to be even a slight increase in price.

Additionally, a large proportion of Netease's revenues come from monthly subscriptions. That benefits the company because it first provides a steady flow of money that can be reinvested or paid out in dividends. Subscribers are generally exceptionally loyal and this makes the entire NetEase eco-system more 'sticky'.

- High return on equity: At the time of writing, NetEase has earnt a 30 percent return on equity using barely any borrowed money. This is despite the fact that the company is still in a massive growth phase and is still far away from maximizing its economies of scale. This is outstanding for a company with a ~$36 billion dollar market cap.

- A flourishing E-Commerce platform: NetEase has launched the Kaola and Yanxuan platforms that sell high-end products directly to consumers. These platforms have grown very fast and will be a formidable source of revenue in the future, despite not making money today. I believe that the market is valuing NetEase almost entirely off its video game business, which seems too conservative. There doesn't seem to be any reason to doubt that NetEase will be able to make a significant profit in E-commerce in the future and I don't think this is priced into the security at all. In the future, this could easily be a $50 billion dollar business.

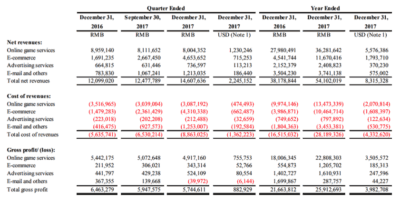

Source: NetEase Quarterly Earnings Release

- NetEase has operated in an industry with high barriers to entry. The company is 'protected' by the Chinese government. Foreign companies are limited in their ability to enter the Chinese market given government restrictions, which prevents international rivals from entering directly. Major Western companies such as Activision Blizzard, Zynga and Google, therefore, license their games to Netease which then distributes them to the Chinese market. For example, Microsoft gave Netease the license to distribute Minecraft in China, one of the most popular games of all time.

As for domestic rivals, 70 percent of the market is dominated by NetEase and Tencent, with NetEase actually having increased its market share year after year for the last 3-4 years. Despite this amazing business model and all these competitive advantages, Netease shares trade at a current price to earnings ratio of only 18, this basically implies minimal future growth: this seems very unlikely.

Conclusion

NetEase's shares have dipped in recent months, given a slight sequential decline in video game sales last quarter. However, for investors with a long-term orientation, it seems clear that the future growth of Netease is definitely not priced in the stock. Shares are a fraction higher than what I would recommend paying. In my opinion, NetEase is a Buy if the stock reaches $250 or less.