A favourite among Australian portfolio managers is Woodside Petroleum Limited (ASX: WPL). Woodside is Australia's largest independent oil and gas company, an explorer, developer and supplier of energy. The company has a formidable global portfolio and operations across five continents.

Woodside has also shown itself to be resilient in a very challenging environment for oil producers, and has demonstrated that it has a sustainable business model as a low-cost energy supplier. It has driven down unit production costs over the last four years, while increasing its sales volume to achieve record levels of production. The main reason you should stay away

from Woodside Petroleum is simply the company's valuation.

How to value an Oil Company

The most important consideration when valuing an oil company is the total number of oil reserves (barrels of oil equivalents) which the company possesses. Oil reserves are the lifeblood of any oil producer. Companies that engage in upstream production must constantly explore to replenish their reserves and the carrying value of their existing reserves depends on the price of oil.

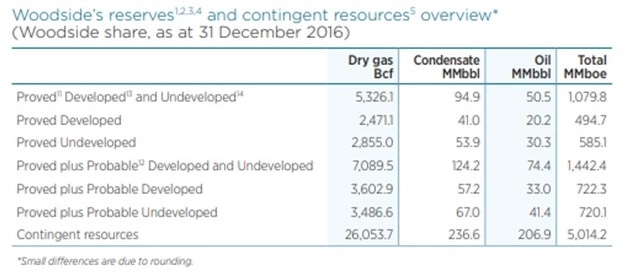

Let's take a look at Woodside's reserves.

As we can see, the company has total contingent reserves of 5 billion barrels of oil. With the current oil price of a barrel of oil being ~AUD$84, the total value of Woodside's reserves is a maximum of around AUD$42 billion dollars, assuming that 100 percent of their probable reserves were to be recovered. A more realistic estimate, would probably value Woodside's reserves at around AUD$37 billion, allowing for some lost reserves.

Given that the entire capitalisation of the company is around AUD$27 billion, an investor who purchases shares of Woodside Petroleum is currently paying $1 for every $1.50 of reserves that the company holds. Given that it is quite expensive to extract oil reserves, this is hardly a bargain.

The second part of the equation: Free Cash Flow

Integrated oil companies also have extremely high capital expenditures. Capital expenditures are required for these companies to maintain their infrastructure, as well as continuously explore for additional reserves. An oil company which fails to replenish reserves, would become bankrupt of course!

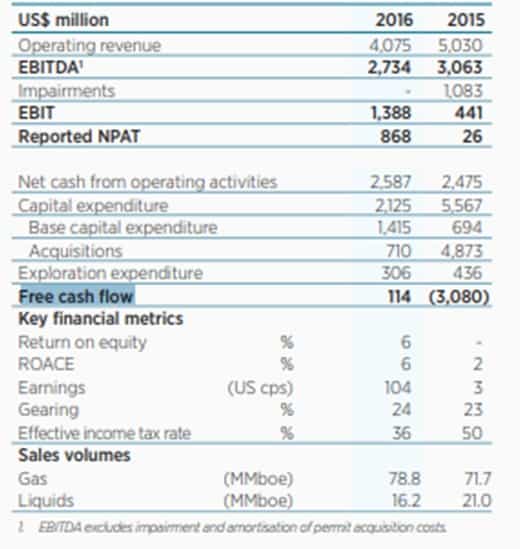

A picture of Woodside's cash flows

As we can see, the company generated $2.7 billion of EBITDA earnings, but incurred base capital expenditures of $1.4 billion and exploratory expenses of $300 million. This means that effective earnings were only really $1 billion dollars last year. This number is 40 percent lower than the earnings stated on the bottom line.

Let us consider some mathematics.

The company also only has between 12-15 years of oil reserves left in its portfolio, given its current annual production. The $710 million dollars which it spent on acquisitions therefore look quite necessary and it is clear that without continually spending to acquire additional reserves, the company will not be able to sustain its current level of output.

Look at the last two years; it becomes clear that the company has actually struggled to generate free cash flow. Woodside's capital intensity means that the company shoots through its cash quickly. Its dividend policy places further pressure on the company to draw upon its cash or borrow funds. The company is therefore in a much more fragile position than may

seem at first glance.

Foolish takeaway:

Investors who haven't bought shares of Woodside should continue to avoid the company. Those who already have a position established might want to consider shifting their funds toward more attractive investment opportunities.