The Catapult Group International Ltd (ASX: CAT) share price rose 2% to $1.20 this morning after the company returned to trade, having raised $25 million during a trading halt yesterday. The halt may have come as somewhat of a surprise to shareholders, given that Catapult generated $7m in cash from operations in the first half and had $18 million cash in the bank.

Catapult declined to offer a share purchase plan to ordinary shareholders. Following the raising, the company may have around $43 million in the bank, with much of this earmarked for the expansion of the company's US sales teams and the rollout of the Prosumer product in the 4th quarter of 2018.

After this raising, Catapult stated "based on the Company's current strategy and supported by its three-year plan, management does not anticipate requiring additional equity funding [having to issue new shares to raise capital] before becoming cash flow positive."

So is Catapult a buy?

I'm in two minds on this company. First I think, given that Catapult is well funded, trading at 3-year lows, and about to roll out its Prosumer offering widely, surely now is the time to look more closely at the company.

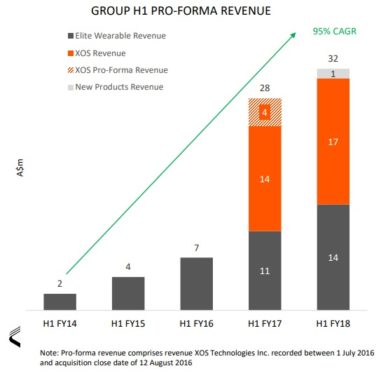

On other hand, I think that Catapult has been relying on raising equity to acquire new businesses and in my opinion this has added a lot of complexity to the business without demonstrably creating significant value. For example I found this chart to be a bit of a joke:

The claimed 95% compound annual growth rate (CAGR) is primarily due to all the additional capital ($80 million!) that the company raised and used to acquire businesses like XOS. You can draw your own imaginary line above the grey bars (the core business) and see what the actual growth rate has been like.

Don't get me wrong – raising capital when share prices are high to buy businesses can be smart. However, to my mind, Catapult's underlying growth rate is a lot lower, and I don't think the company has demonstrated that it's really generating value or traction with consumers. Following the roll-out of the Prosumer offering in the 4th quarter this year, I expect the next 12 months will be very telling for Catapult.

Having said that, the current price appears to be around 3x forecast earnings before interest, tax, depreciation, and amortisation (EBITDA), which is not demanding, if you expect that the product has loyal consumers and can maintain and grow earnings.

I would like to like this company, and although I am unsure as to whether Catapult can live up to expectations, I think it could be worth closer investigation.