The sky has not fallen in on the banking sector and the reasonably solid results from Commonwealth Bank of Australia (ASX: CBA) and National Australia Bank Ltd. (ASX: NAB) shows the sector is well placed to weather any potential storms this year.

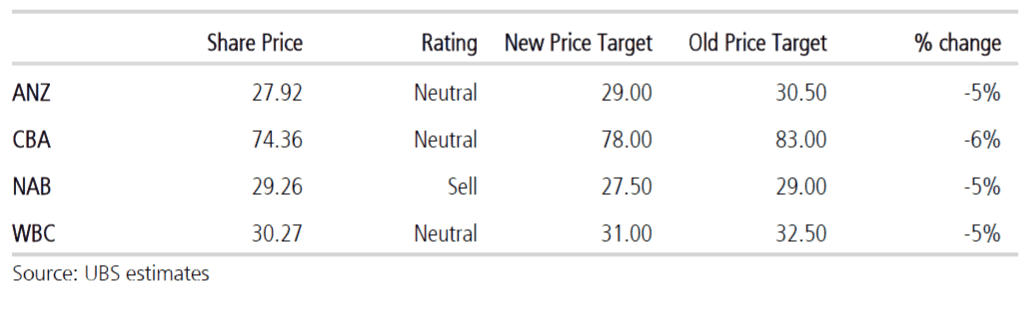

But investors are getting a little too complacent on the risks facing our favourite banks and UBS warns that the sector will struggle to outperform in the current climate as it cuts its price targets on the Big Four by 5% to 6%.

None of the Big Four, which also includes Westpac Banking Corp (ASX: WBC) and Australian and New Zealand Banking Group (ASX: ANZ), are worthy of UBS' "buy" rating even though the stocks have been de-rated and have underperformed the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) by at least 10.5% over the past 12 months.

Don't Bank On It: Downgraded price targets on the Big Four

This is despite the latest round of results that showed solid asset quality, low loan defaults despite cost of living pressures, and generally stable or growing net interest margins (NIM).

The banks may even have a growth lever they could pull. UBS observed that CBA and Bendigo and Adelaide Bank Ltd (ASX: BEN), the two banks that reported an increase in NIM this month, have cut the interest they pay on deposits.

This trend is likely to persist due to repricing challenges on mortgage back-books (medium to long-term mortgage customers), slowing credit growth, a contraction in wholesale funding spreads and the fact that they've hit their liquidity risk ratios (meaning they don't need extra depositors to cover their lending risks).

Savers were done-over when interest rates plunged to record lows and they still look done-over now that rates are moving higher!

More power to the banks as they can use this to protect or grow NIM in 2018.

But this won't offset the growing headwinds in the banking sector. One big headwind is the banking Royal Commission that will focus on the $1.7 billion mortgage industry where there is mounting evidence of bad behaviour by the banks.

"The focus of the Royal Commission on Responsible Lending and mortgage mis-selling is extremely important. We believe that if the Royal Commission finds the banks have not lent responsibly this could potentially open the banks up to class actions which may have material consequences," said UBS.

"However, following 73 investigations into the banks since the financial crisis we can understand investor complacency into these risks."

If the Royal Commission has more bark than bite, then the banks look to be fair value (maybe even cheap given their underperformance!).

But if the Royal Commission paves the way for class action lawsuits – and you can bet that the law firms like Slater & Gordon Limited (ASX: SGH) are rubbing their hands in anticipation – then shares in the Big Four are likely to fall further.

UBS has cut the price targets of the Big Four to account for these increasing risks.

This isn't to say there are no opportunities among blue-chips. If anything, the experts at the Motely Fool have nominated their favourite blue-chips for 2018.

Click on the free link below to find out what these stocks are.