The Telstra Corporation Ltd (ASX: TLS) share price will be one to watch this morning following the release of the telco giant's half-year results.

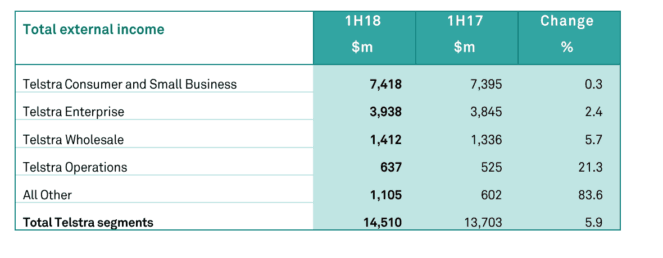

According to the release, Telstra posted revenue (excluding finance income) of $12,907 million and total income of $14,510 million for the six months ended December 31. This was an increase of 0.8% and 5.9%, respectively, on the prior corresponding period.

Offsetting the increase in total income was its operating expenses. During the period operating expenses grew 10.6% to $9,418 million. Ultimately, this led to first-half EBITDA sliding 2.5% to $5,061 million.

First-half profit came in at $1,976 million before impairments or $1,703 million when accounting for the $273 million impairment made against its Ooyala business. This was an increase of 10.3% and a 4.9% decline, respectively, on the first-half of FY 2017.

Telstra reported earnings per share of 14.3 cents for the period and declared an interim fully franked dividend of 11 cents per share. As expected, this was made up of a 7.5 cents per share ordinary dividend and a 3.5 cents per share special dividend. The record date for both dividends is March 1, with payment then expected to be made on March 29.

As you can see below, the main drivers of its top line growth were the Telstra Enterprise and Telstra Wholesale businesses. The Telstra Operations business also grew strongly, albeit from a lower base. Its key Consumer and Small Business segment posted negligible growth due to the continued decline of its Fixed Voice business.

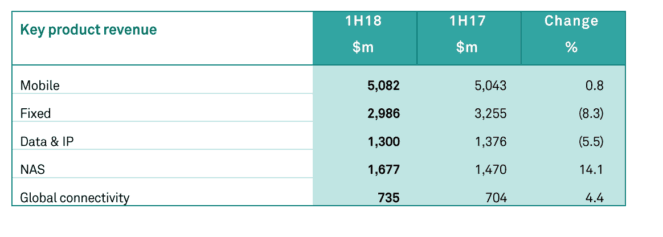

Across all its segments this led to the following product revenue:

How does this compare?

According to a research note out of Goldman Sachs last week, the broker had expected a 3% increase in revenue to $14,100 million, flat EBITDA at $5,400 million, and net profit after tax of $1,900 million.

Based on Goldman's estimates Telstra hit two out of three targets. Though, this miss on EBITDA is arguably a big one and was the result of EBITDA margin declines across all its businesses. Something which I would hope to see a big improvement on in the second-half.

Should you invest?

I still think that Telstra is a good option for investors, especially those looking for a source of income. Whilst I wouldn't rush into buying its shares today, when the dust settles I think it could be worth considering ahead of rivals TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC).