The oOh!Media Ltd (ASX: OML) group is one of Australia's largest out-of-home media companies providing advertisers with a diverse range of audiences across multiple environments.

These channels include; roadside advertising, retail advertising within shopping centres, advertising within airports and other locations within high-dwelling areas such as CBD office buildings and gyms.

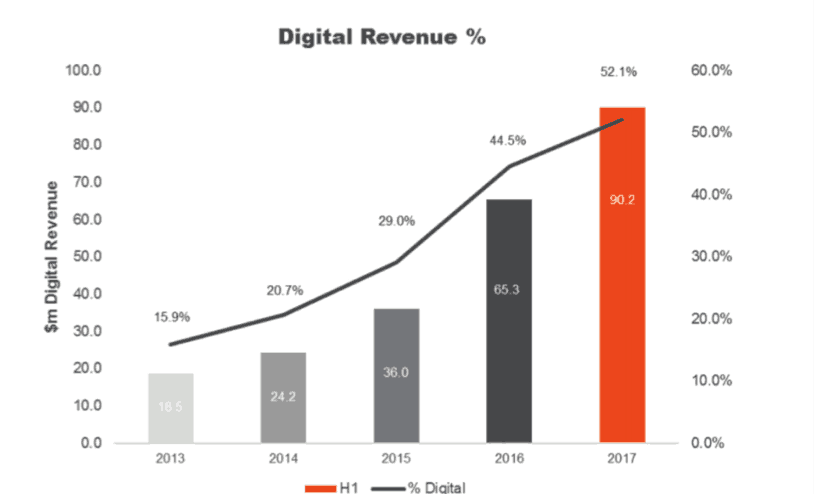

oOh!Media has extensive operations throughout both Australia and New Zealand with more than half of the group's revenue now being derived from its portfolio of digital signage assets.

The group reported on its half-year earnings during August posting strong revenue growth of 18% to $173 million and underlying earnings (EBITDA) growing 27% to $34 million. Since the half year reporting period the share price has rallied between highs of $4.84 and a low of $4.16.

It appears as if buyer sentiment has improved along with economic conditions with reports indicating that the digital out-of-home market in Asia Pacific is expected to grow at the highest Compound Annual Growth Rate (CAGR) during its most recent forecast period. This is significant given that the recent company profit report indicated for the first time that revenue from its digital portfolio had exceeded 50% of total revenue to hit $90.2 Million.

Source: oOh!Media Half-Year Report

Is it a buy?

I think today's prices present a good buying opportunity for buy-and-hold investors. The positive earnings results and outlook within the sector especially as we move into the holiday period should lay the foundations for a promising full year reporting season.

At 21x annualised earnings the share price does have some baked-in growth compared to the market and sector.

However, I believe this could be justified given the company's focus on continued investment for long-term growth. Impressively the group was still able to offer a 10 cent per share fully franked dividend following the previous financial year's reporting. After making a number of acquisitions during the year it remains to be seen if this will be repeated.

Are there risks involved?

Being a competitive sector with a large number of multi-national vendors operating within the Australian and New Zealand market the landscape can change quickly. However, in line with the recent acquisitions and strong growth coming from the company's digital revenue stream, I believe the company is on track to deliver on its full year guidance of between $88 million and $92 million in earnings (EBITDA).