The Wesfarmers Ltd (ASX: WES) share price is riding high, but a patient investor should consider waiting for a more compelling valuation.

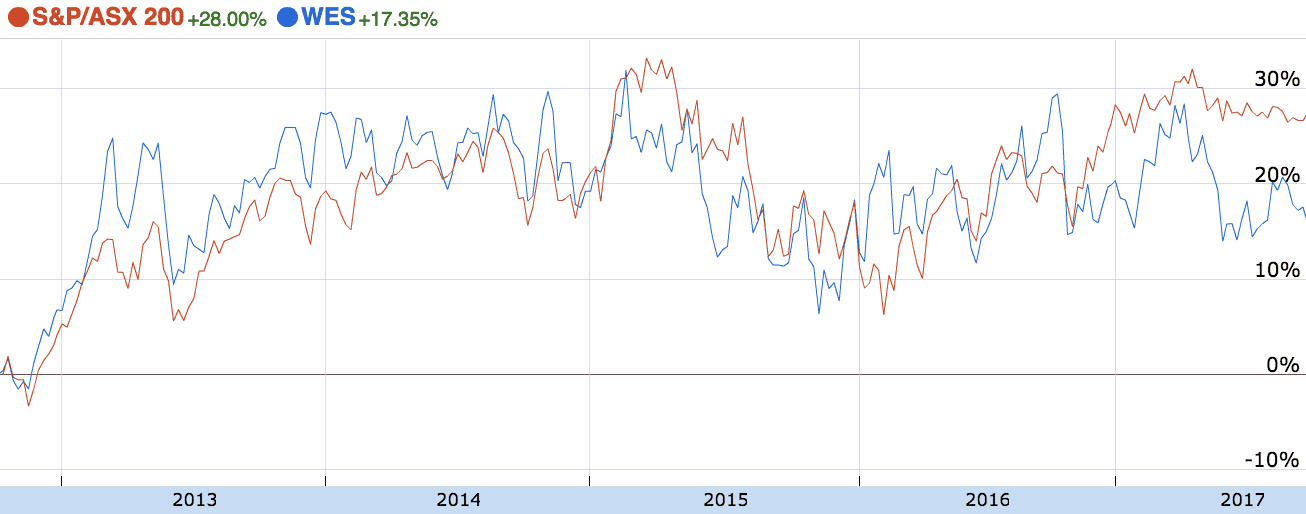

Wesfarmers V. ASX 200

As can be seen in the chart above, Wesfarmers shares have tread water, moving mostly sideways, for a few years now. Over the past five years, the market or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) has outperformed Wesfarmers by around 10%, not including dividends.

Nevertheless, despite its soft performance, here's why Wesfarmers shares are on my watchlist.

3 reasons Wesfarmers shares are on my watchlist

- Leading brands.

Wesfarmers is the owner of Kmart, Coles, Bunnings Warehouse, Officeworks and more. I don't know about you, but at least half of my house is designed and supplied by Kmart, Bunnings and (my office especially) Officeworks.

While that doesn't tell us much about the company's economics and profitability, it speaks to the popularity of its businesses.

- Leadership.

Wesfarmers is a well-run company. From the top to the bottom, people genuinely want to work for Wesfarmers and its subsidiaries. Bunnings, Australia's number-one home improvement and outdoor living company, has great levels of customer and employee satisfaction.

- Valuation.

The reason Wesfarmers shares are on my watchlist and not in my portfolio is its valuation. I would buy Wesfarmers shares if they were fairly valued but they are expensive, in my opinion.

Foolish Takeaway

Wesfarmers is a great business. But with a modest growth outlook and expensive price tag I can't bring myself to buy shares for my portfolio. Therefore, they will stay on my watchlist, for now. In the meantime, there are thousands of other great companies which are worthy contenders of my capital.