ARB Corporation Limited (ASX: ARB) shares and WiseTech Global Ltd (ASX: WTC) shares are potential ASX blue chip shares worthy of a spot on your watchlist.

ARB and WiseTech shares rally

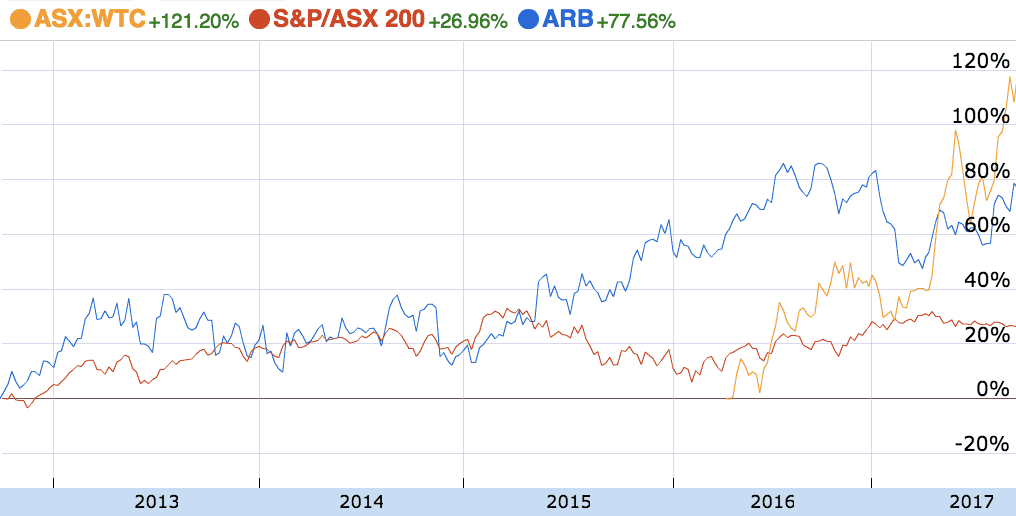

As can be seen above, these two 'mid cap' companies have handily beaten the broader market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), in recent times.

ARB Corp

ARB is Australia's leading bull bar and 4×4 accessories business. The small red "ARB" logo is ubiquitous in Australia's outback and school car packs. The family-run company has taken the fight to its nearest competitor, TJM, by offering in-depth research and marketing with its latest models.

It is now growing its presence abroad in parts of Europe, the Middle East and USA. However, in my opinion, ARB shares are around fair value at today's prices. That means ARB shares are not a standout buy.

WiseTech

WiseTech is a relatively new name on the ASX boards, having listed in 2016. Despite the option of listing on overseas markets, WiseTech's listing offers local investors exposure to a first-class global software business. WiseTech develops and markets a sophisticated and integrated logistics software, which — if you invest in thematics — plays into the rise of more online shopping and local delivery.

Despite a risk of losing the opportunity to buy WiseTech shares at current prices, it appears to me that they are currently quite expensive. Therefore, I wouldn't be comfortable buying shares today.

Foolish Takeaway

I really like ARB Corp and WiseTech. I think each company offers a market-leading product, is well-run and is transparent with investors. Unfortunately, their shares do not come cheap. Therefore, I'm keeping them on my watchlist, for now.