Following a strong recovery earlier this year, the Woolworths Limited (ASX: WOW) share price is riding higher. However, even at today's prices it is yielding dividends of 3.5% fully franked.

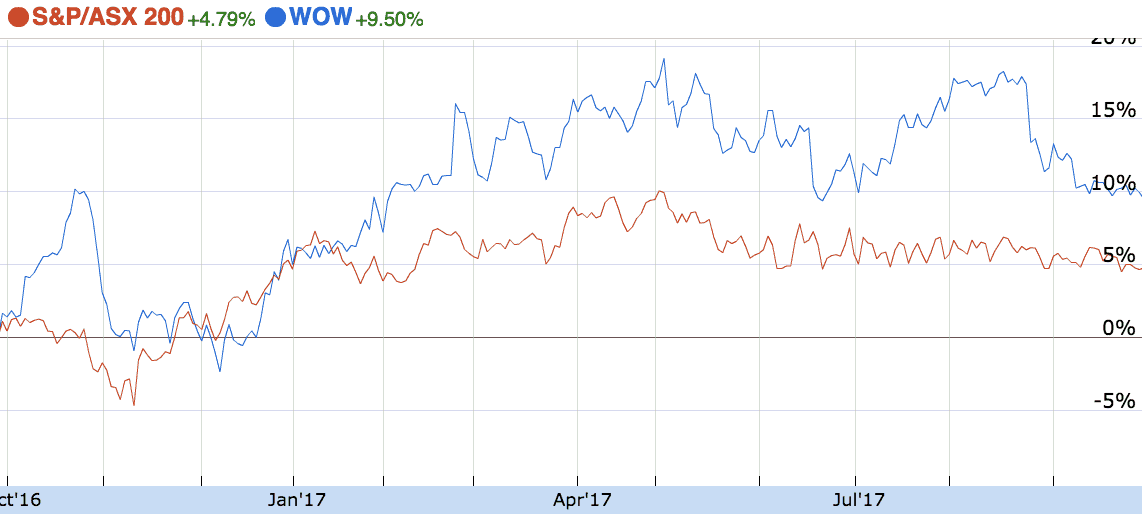

Woolworths share price

Over the past year, Woolworths shares have outperformed the Australian market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), by around 5% not including dividends.

Is 3.5% with franking credits enough?

At 3.5% fully franked — around 5%, if you are eligible for the franking credits — Woolworths shares are offering nearly double what you could get from the bank.

For example, a term deposit with Commonwealth Bank of Australia (ASX: CBA) is offering 2.2%.

However, after taxes (say, 30% of that 2.2%) and inflation (1.9%) you are coming out worse off in a term deposit, from an inflation-adjusted perspective.

So, it is a no-brainer: 5% is better than 2.2% — right?

Not so fast, Buster.

Shares are riskier than term deposits. And if Woolworths' decision to cut its yearly dividends from $1.39 per share to $0.77 per share in 2015 is anything to go by, well… you should demand a pretty hefty return for your money.

Growth + income

Fortunately, shares offer more than just dividends. If you buy the right company, you will receive dividends and the share price will increase over the years.

To assess the investment opportunities you need to consider the potential risks and the potential reward.

In my mind, the arrival of Amazon, the ongoing growth of Aldi, and its price war with Coles is only going to intensify — dampening Woolworths' growth prospects.

From my morning Twitter feed, I learned today that Amazon's founder Jeff Bezos considered naming the $575 billion e-commerce giant "Relentless", which is fitting given the impact it has had on the retail industry.

Bezos considered naming Amazon Relentless.

He still owns the URL https://t.co/ZWUHzV2rDA

From the new @profgalloway book which is 👌

— Irrelevant Investor (@michaelbatnick) September 27, 2017

Ultimately, investors eying off shares of Woolworths for a buy and hold must demand a discount to its current market price given that profit growth may be hard to come by in future years.

Foolish Takeaway

Woolworths shares are offering a modest and potentially tax-effective income stream to investors. Unfortunately, its current share price leaves a lot to be desired.