BHP Billiton Limited (ASX: BHP) shares have bounced back from a trough with commodity prices and profits buoying the miner's share price.

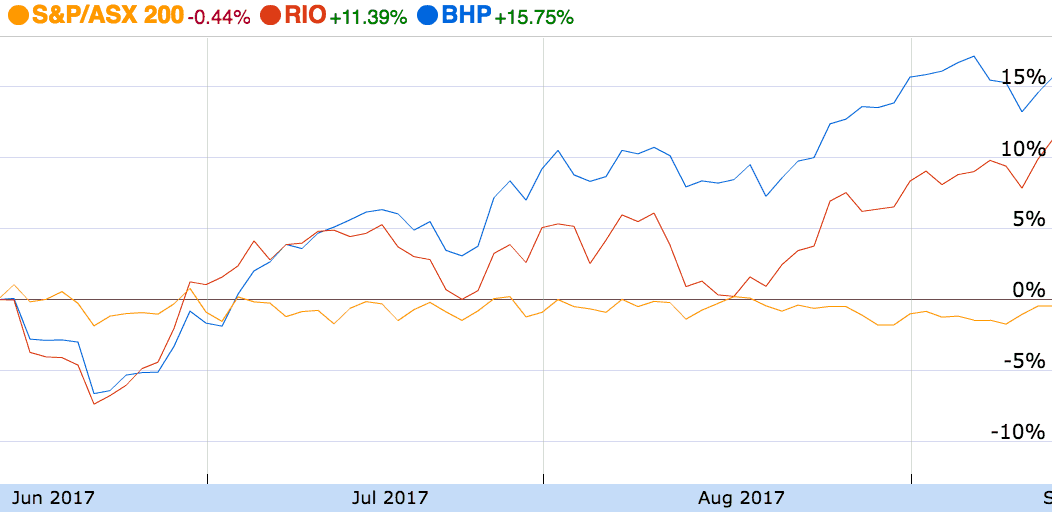

BHP share price

As can be seen in the chart above, shares of BHP and its rival Rio Tinto Limited (ASX: RIO) have been firing on all cylinders over the past three months, handily outperforming the broader S&P/ASX 200 (Index: ^AXJO) (ASX: XJO).

Last month, BHP reported a 20% increase in yearly revenue to $US38.3 billion and a profit of $US5.9 billion, sharply higher than the prior corresponding period. It also reported a significant step-change in net cash flow thanks to higher commodity prices.

"Miners were the standout in every metric through the reporting season," Macquarie strategists were reported saying by Fairfax. "Operationally, they continue to surprise on the cost side and mark to market commodity price moves are still driving large upgrades – no different to the past 18 months."

Overnight, iron ore futures rose again, as Chinese commodity traders prepare for the upcoming construction season. Oil, another of BHP's key commodities, has also maintained its price strength in recent months.

Is it time to buy BHP Billiton shares?

According to Macquarie analysts, it's time to be 'overweight' the resources sector, with miners in strong capital positions as a result of their robust cash flows.

Indeed, if commodity prices continue to hold up it may be worth running the ruler over BHP, Rio and Fortescue, which have come back from the brink over the past two years and appear stronger as a result.

However, I'm not actively looking to buy BHP shares at this time because I believe mining companies are inherently riskier than industrial businesses. In addition, I find them very difficult to value because commodity prices are next to impossible to forecast with any certainty.