The Webjet Limited (ASX: WEB) share price rose 5% to $11.82 today after the company released its annual results. Management also appears to have put the audit opinion behind them. Here's what you need to know:

- Total transaction volume (TTV) rose 25% to $2,043 million

- Revenue rose 52% to $235 million

- Earnings before interest, tax, depreciation and amortisation (EBITDA) rose 91% to $70 million

- Net profit after tax (NPAT) rose 147% to $52 million

- Earnings of 53.8 cents per share

- Dividends of 17.5 cents per share

- Outlook for continued growth in market share, targeting 3x the underlying market growth rate over the next 3 years

The audit

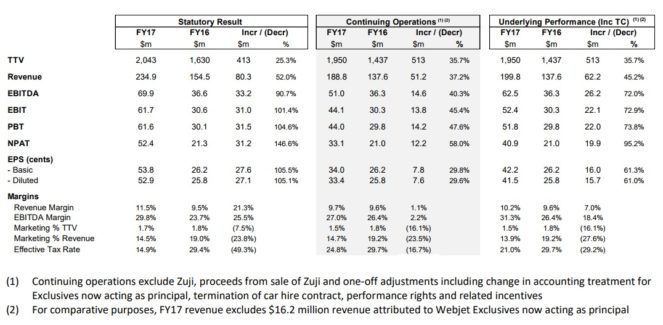

First it is necessary to draw attention to the complexity of Webjet's results. I quote the statutory results above because in my opinion they best reflect what actually happened during the year, including items like the sale of Zuji and so on. However, as you can see below, there are three different versions of Webjet's earnings for the year (click to make the image larger):

The important thing in my opinion is to note that all of the metrics are moving in the right direction. There are no losses mysteriously becoming profits, for example. After an initial disagreement, management ended up adopting their auditor's proposed accounting treatment for Thomas Cook. Webjet now expects a clean tick of approval from the auditor by the time the formal annual report is released.

The business

Webjet made solid progress in its core business during the year and reported strong growth at its recently acquired Online Republic and FIT Ruums business. With the recent acquisition of JACTravel, WebBeds is now the #2 player in the global B2B (business to business) market. Management continues to focus on growing market share in both B2B and B2C (business to consumer) markets, and has switched the focus from Total Transaction Volume (TTV) to number of bookings as a measure of market share. This will likely better represent market share growth in lower-margin products than pure TTV alone would.

The outlook

The tricky part for Webjet shareholders now is valuing it. The business itself is growing at a healthy rate and has a number of new opportunities in the works. Clearly, Webjet could become larger in time. However, the company is priced at 33x earnings based on the central 'continuing operations' (excluding earnings from the divested Zuji) scenario above. On that metric, Webjet looks a little pricey. Still, it is generating lots of cash and keeps most of it to reinvest in growth. I wouldn't bet against Webjet, and may look to buy shares myself on any pullbacks.