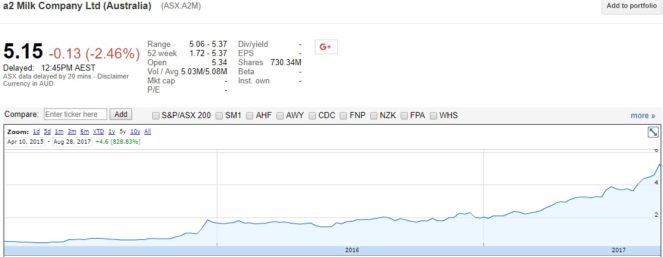

There's no question that A2 Milk Company Ltd (Australia) (ASX: A2M) has become one of the hottest companies on the ASX at the moment, with its share price tripling in just over a year:

I've already described A2 as 'the one that got away' from Freedom Foods Group Ltd (ASX: FNP), which would now be at least $500 million richer if it had kept its shareholding in A2. But that's ancient history now, the real question is – can A2 Milk shares go even higher?

To answer that question, I think it is necessary to differentiate between the share price and the value of the business. I do not think the A2 share price will hit $6 any time soon. If anything, I think it is probably overpriced, and as I wrote here I think investors may want to look at trimming some of their shareholding.

However, over the longer term – say 3 to 5 years – I think A2's business has a good chance of being worth $6 per share or more. Most of A2's earnings still come directly from the ANZ region (although arguably some of this is due to export sales into China), and the company is expanding into the UK, USA, and China. Each of these markets dwarfs the ANZ region and could potentially see A2 multiple in size several times over.

The company may also gain additional pricing power and market share if its research into A2 proteins bears fruit. Conversely, the breeding of A2 cows is hardly patent-protected and there is the opportunity for competition and imitators to try and muscle in on A2's niche. So continued expansion carries a number of risks, many of which are being overlooked by the currently buoyant share price, in my opinion.

If I were buying A2 Milk today, I would be looking to keep it to a smaller part of my portfolio while I see how the company progresses.