The Nearmap Ltd (ASX: NEA) share price dropped 6% following the release of its annual results this morning. Here's what you need to know:

- Revenue rose 31% to $41 million

- Loss after tax fell 26% to $5.3 million

- $28 million cash at bank

- Customer numbers grew 9% to 7,832

- Average revenue per subscription (ARPS) grew 18% to $5,996

- Customer churn fell from 13% to 10%

- Outlook for double digit growth in Australia, and ACV expected to double in USA

So what?

Another strong result from Nearmap, which reported strong progress on its important metrics. Customer numbers grew, each customer is spending significantly more, and customers are sticking around for longer. Importantly, the loss-making US segment is making good progress and is approaching break-even, while the Australian business is also growing at a respectable clip:

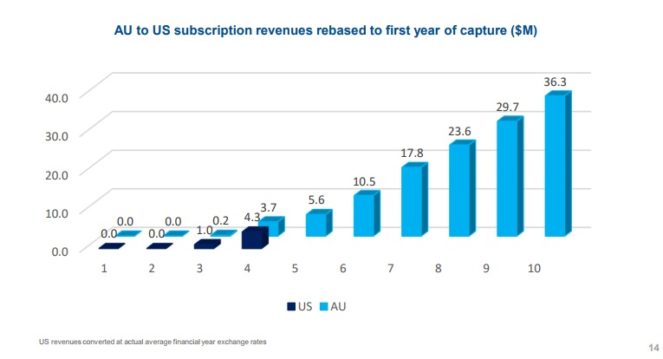

I like this chart, which has been a recurring feature in Nearmap presentations for a few years now, because it shows clearly the progress in the US relative to Australian progress at a similar date. The US market is way under-penetrated compared to Australia, and Nearmap continues to invest in increasing its population cover and capture frequency. In 2017, Nearmap's marketing team managed to win $5.6 million in annualised contract value (ACV) from its $5.8 million expenditure on marketing. If customer churn continues to fall, these marketing efforts could add a significant amount of value over time.

Now what?

The two big questions for Nearmap in my opinion are 'can it become profitable from its existing cash balance' and 'what will it be worth if it does?' If the company is able to achieve a similar level of annualised revenues in the USA as it does in Australia, and at a similar 90% gross margin, buyers at today's prices should be nicely rewarded. With the value that is being added by the investment in marketing as well as by increasing the capture coverage, it makes sense for Nearmap to continue generating losses as it invests in growth. At today's burn rate of around $6 million per annum, Nearmap has approximately 4 years of operations left before it may need to raise more cash, which gives the company plenty of time.

Still, Nearmap remains high risk and should be confined to a smaller part of your portfolio as a result.