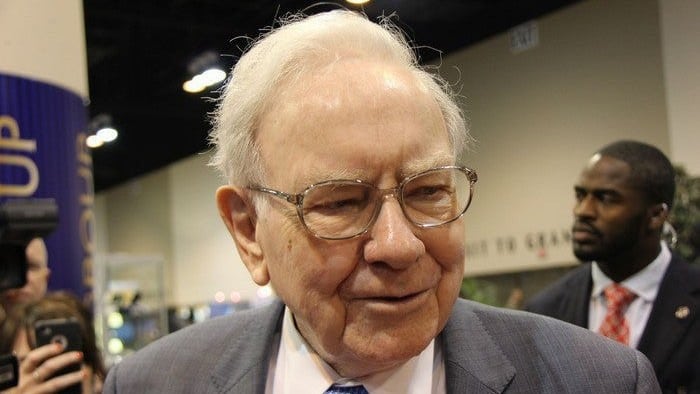

When people think about Warren Buffett, they often picture someone poring over annual reports and hand-selecting individual stocks.

That approach has worked extraordinarily well for him. But what many investors don't realise is that you can follow the style of Buffett's strategy without ever having to choose a single ASX stock yourself.

In fact, Buffett has repeatedly said that most everyday investors are better off keeping things simple.

Investing like Warren Buffett

At the heart of Warren Buffett's philosophy is a straightforward idea.

He likes to invest in high-quality businesses that can grow earnings over long periods of time. The Oracle of Omaha avoids speculation, short-term trading, and attempting to time the market.

Instead, he looks for durable companies with strong competitive advantages and fair valuations and then holds them patiently.

The good news is that you don't need to identify those businesses one by one to apply this thinking. Broad, rules-based investing can achieve a similar outcome.

Use diversified ETFs as your foundation

One of Warren Buffett's most famous pieces of advice is that most investors should simply buy a low-cost index fund and hold it for decades. That advice translates very neatly to the ASX.

A broad Australian market ETF, such as the Vanguard Australian Shares Index ETF (ASX: VAS), gives exposure to many of the country's strongest businesses in one investment. Companies rise and fall over time, but the market as a whole has historically grown alongside the economy.

In fact, for every correction, crash, selloff, or meltdown, the Australian share market has eventually rebounded and hit new record highs.

Buying an index fund removes the risk of backing the wrong individual company while still capturing long-term growth.

You can also take this idea global. Buffett has often highlighted the strength of the US economy, and international-focused ETFs, such as the iShares S&P 500 ETF (ASX: IVV), allow Australian investors to benefit from the world's most successful businesses without needing to analyse them individually.

Tilt towards quality

Another hallmark of Buffett's style is his preference for businesses with economic moats. These are advantages that protect profits from competitors.

While identifying moats at a company level can be difficult, there are ETFs designed to tilt portfolios toward quality characteristics such as strong balance sheets, reliable cash flow, and pricing power. One of those is the VanEck Morningstar Wide Moat AUD ETF (ASX: MOAT).

By owning a basket of high-quality stocks rather than trying to identify the single best one, you reduce risk while staying true to Buffett's core principles.

Let time and compounding do the work

Perhaps the most underrated part of Warren Buffett's success is patience. He has often said that his favourite holding period is forever.

Long holding periods allow compounding to work quietly in the background, turning steady returns into substantial wealth over time.

Investing regularly, reinvesting dividends, and resisting the urge to react to short-term market noise are all ways to mirror this mindset without active stock picking.

By following these principles, you give yourself a great chance of success over the long term.