This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia and Tesla had impressive gains during Q3.

- Thiel purchased Microsoft and Apple shares during Q3.

Peter Thiel is a legendary personality in the tech space. He's a cofounder of PayPal and Palantir, and was one of Facebook's (now Meta Platforms) first outside investors. That's an impressive resume, and makes following his investment moves a wise idea.

During Q3, Thiel's fund made two surprising moves: It sold a ton of Tesla (NASDAQ: TSLA) stock and completely exited its Nvidia (NASDAQ: NVDA) position. In its place, he purchased Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT).

Those are some interesting moves, but are they the right ones? Let's find out.

Peter Thiel is sitting on a large pile of cash after Q3

There are many reasons why someone might sell a stock. The most obvious is that they've lost faith in a position or feel that a stock has gotten overvalued, and it's time to move on. Another possibility for someone like Peter Thiel is that he may have found something else more lucrative to invest in. Lastly, Thiel could be making a substantial purchase and just wants the money to fund that.

However, there's only one reason why Thiel is purchasing stocks like Microsoft and Apple: He thinks they will go up.

To determine if he rolled the money from Tesla and Nvidia into Microsoft and Apple, let's look at the sales and buys and see if it was a direct transfer or if he's sitting on a big pile of cash. Determining exactly when Thiel sold the stocks isn't possible, so we need to make a few assumptions.

During Q3 2025, Tesla's stock traded at a low of $294, an average of $347, and a high of $445. Nvidia's stock traded at a low of $153, an average of $174, and a high of $187. That's a wide range of prices Thiel could have sold at, so we'll use the average to determine the total dollar figure of the sales.

Thiel sold nearly 208,000 shares of Tesla during Q3, which works out to about $72 million worth of Tesla stock. He sold 538,000 shares of Nvidia in Q3, which is $94 million worth of Nvidia stock.

Switching gears to Microsoft and Apple, he owned zero shares of each during Q2, so it's easy to figure out the average value of these investments. With Thiel owning 49,000 shares of Microsoft and 79,000 shares of Apple, these two positions would have cost him about $25 billion for the Microsoft purchase and $18 billion for the Apple purchase.

That is nowhere near the amount of money he cleared from the Tesla and Nvidia sales, so it's fairly obvious that Thiel is sitting on a big pile of cash after his Q3 transactions. He may use that to invest in an exciting artificial intelligence (AI) or even a quantum computing start-up, or he could be getting worried about the valuation of the market.

Either way, the move from Nvidia and Tesla conveys that he's de-risking his portfolio. Microsoft and Apple are much safer stocks than Tesla or Nvidia, so this move is clearly a defensive one. However, I don't think one of the moves was correct.

The move to sell Nvidia and buy Apple is questionable

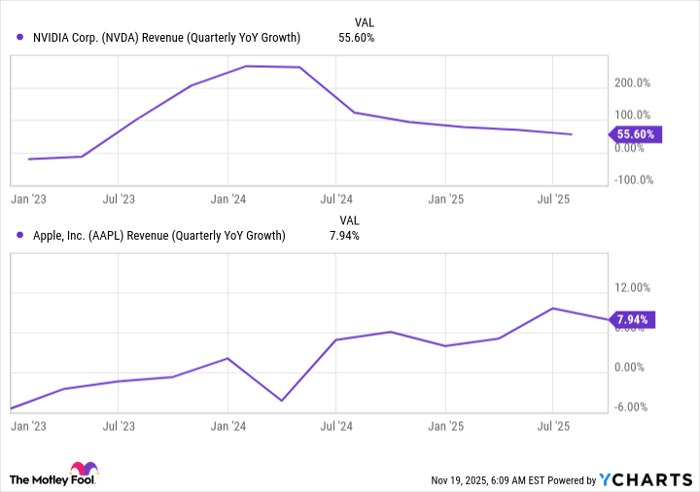

While I have no problem selling Tesla to buy Microsoft, the biggest question for me is: Why would he sell Nvidia to buy Apple? Apple is growing at an incredibly slow pace, with revenue rising at less than 10% for multiple years. Contrast that with Nvidia, which has delivered explosive growth for several years and isn't slated to slow anytime soon due to massive data center buildouts.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

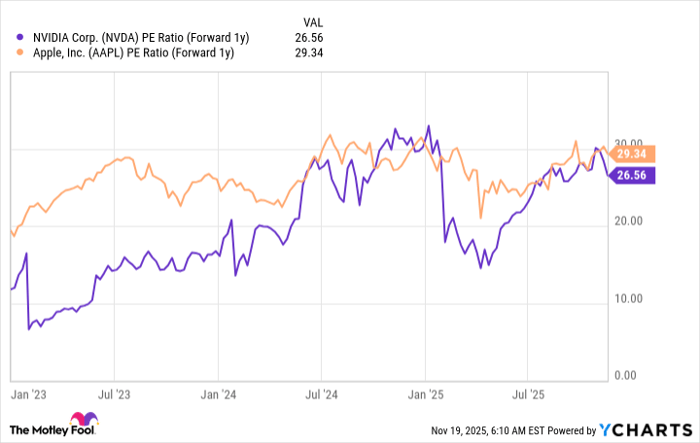

Despite this massive growth mismatch, Apple and Nvidia trade for nearly the same valuation when next year's forward earnings are considered.

NVDA PE Ratio (Forward 1y) data by YCharts

To me, Nvidia looks like the much better stock to buy and hold, but Peter Thiel also has a longer and far more legendary track record than I do. This mismatch of ideas is what makes the market, and investors need to do their own research and thinking to determine if a move like selling Nvidia and buying Apple is right for them.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.