This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Tesla has some exciting products in the pipeline, like the Cybercab robotaxi and Optimus humanoid robot.

- However, most of the company's revenue still comes from selling electric vehicles, and it's losing market share to low-cost brands like BYD.

- Tesla just reported a very positive sales number for the third quarter, but it might have benefited from a one-off tailwind.

Tesla (NASDAQ: TSLA) stock is up by 75% over the past year, as investors place early bets on the success of future products like the Cybercab robotaxi and Optimus humanoid robot. However, 74% of the company's revenue still comes from selling passenger electric vehicles (EVs) like the Model 3, Model S, and Model Y, and sales plummeted in the first half of this year.

Fortunately, Tesla just released its production and delivery numbers for the third quarter (ended Sept. 30) and it appears sales are finally growing again. This is great news for investors, but there's a catch.

Tesla might have borrowed a few sales from the fourth quarter

Tesla's EV deliveries shrank by 1% to 1.79 million units during 2024, marking the first annual decline in sales since the launch of its flagship Model S in 2011. Then, in the first half of 2025, deliveries were down by a whopping 13% year over year, to just 720,803 cars.

Rising competition is a big reason why. For example, Tesla's sales have steadily declined across Europe this year, despite EV sales growing overall across the region. Meanwhile, China-based manufacturer BYD is experiencing explosive demand in Europe, and it even outsold Tesla in July and August. It seems budget-conscious consumers are choosing lower-cost options, rather than premium EVs like those sold by Tesla.

But Tesla delivered 497,099 EVs worldwide during the third quarter, representing an increase of 7% compared to the year-ago period. It was a very welcome return to growth, so is the tide turning? Maybe not -- on Sept. 30, the U.S. government's $7,500 EV tax credit expired, so many American consumers who were planning to buy a car within the next few months probably pulled the trigger earlier to take advantage of the incentive.

In other words, Tesla probably pulled some sales forward from the fourth quarter, which means the October to December period might be considerably weaker, at least in the U.S.

All eyes are on Tesla's future product platforms

Tesla stock is wildly expensive right now (which I'll discuss further in a moment), so it's clear investors aren't valuing the company based on its EV sales alone. Instead, they are looking several years into the future, and trying to estimate how valuable products like the Cybercab and Optimus could be.

The Cybercab is designed to run on Tesla's full self-driving (FSD) software. The company's goal is to have millions of these cars on the road, autonomously hauling passengers around the clock to generate a high-margin revenue stream. However, Tesla's FSD software isn't approved for unsupervised use anywhere in the U.S. just yet, which could be a problem considering the robotaxi is slated to enter mass production in 2026.

Plus, it places Tesla significantly behind the competition. Alphabet's Waymo is already completing over 250,000 paid autonomous trips every single week in five U.S. cities, and it partnered with Uber Technologies, so it has access to the world's largest ride-hailing network. Tesla not only has to prove the viability of its autonomous technology, but it also has to build an entire network from the ground up.

Turning to the Optimus robot, CEO Elon Musk believes this product platform will generate $10 trillion in revenue for Tesla over the long term, because humanoid robots will have several use-cases for both businesses and households. In fact, he believes robots will outnumber humans by 2040.

However, Optimus will take even longer than the Cybercab to make a meaningful contribution to Tesla's financial results. Production is expected to begin in 2026, but Musk says it could take five years to reach Tesla's target output of 1 million units per year -- and that's assuming there is real demand, which is a big unknown right now.

Tesla stock is trading at a sky-high valuation

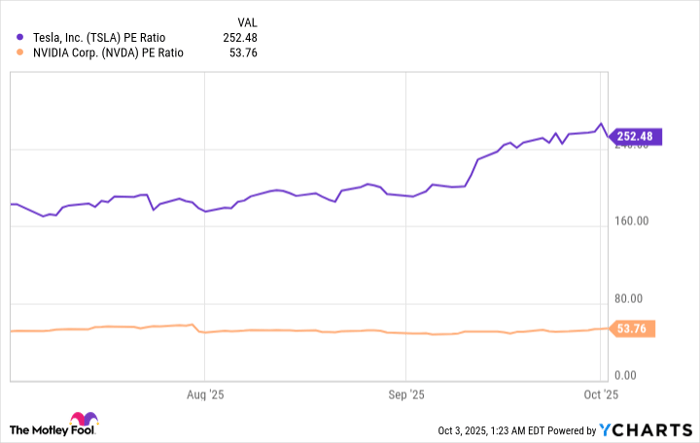

The Nasdaq-100 technology index is trading at a price-to-earnings (P/E) ratio of 32.6 as I write this. Nvidia stock, on the other hand, trades at a premium P/E ratio of 53.7, mainly because of the company's incredible growth and the enormous future demand for its artificial intelligence (AI) chips.

Then there is Tesla stock, which trades at a staggering P/E ratio of around 252. That would be difficult to justify even if Tesla's business was booming, but its earnings shrank by 31% in the first half of this year because of its weak EV sales.

TSLA PE Ratio data by YCharts

As a result, it's very difficult to advocate for buying Tesla stock based on what we know right now, especially with a potentially weak fourth quarter on the horizon. Optimus and the Cybercab would have to become incredible success stories to justify the company's current valuation, but even if you believe that will be the case, it could take several years to unfold.

In the meantime, Tesla's rich P/E ratio leaves its stock vulnerable to a significant correction.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.