This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Tesla's board of directors proposed a package of up to $1 trillion to Elon Musk if it achieves market cap and business milestones.

- Tesla is trying to pivot its business away from selling cars to becoming a more general tech and AI platform focusing on autonomy.

- If Tesla can achieve its lofty goals, it should see a huge boost to its margins and profitability.

It hasn't been the best year for Tesla (NASDAQ: TSLA) so far, with the stock down over 8% through Sept. 8 (the worst-performing of the "Magnificent Seven" stocks). Part of this has to do with the company's lackluster business performance lately, but much also has to do with its CEO, Elon Musk.

Many investors had voiced their displeasure regarding Musk's divided attention, especially during his stint heading the Department of Government Efficiency (DOGE). To refocus Musk's attention solely on Tesla, the company has offered extremely lucrative packages, including the most recent one, which could be worth up to $1 trillion.

There are high expectations that Musk must meet in order to receive the full package, but it does have implications for Tesla's business and its future direction. Let's unpack those.

What does the proposed package include for Musk?

The package, which shareholders will vote on in November, could reward Musk with up to 423.7 million shares (split into 12 allocations) if the company meets a handful of lofty goals. The first part of the goals has to do with Tesla's market cap.

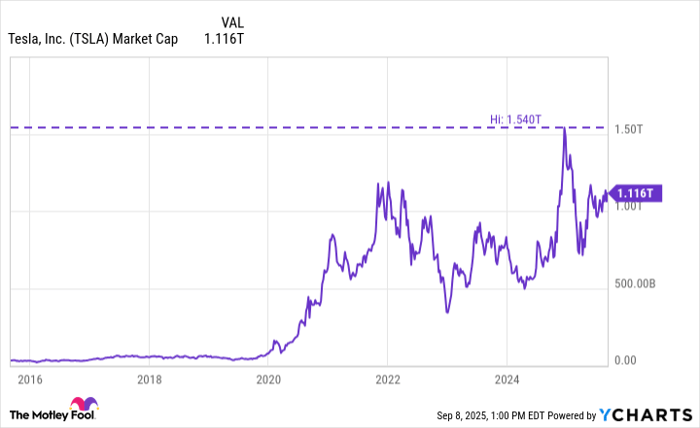

It would need to hit 12 different market cap targets, with the first being $2 trillion (Tesla's market cap at the time of this writing is close to $1.12 trillion). The subsequent nine targets would be in $500 billion increments, and the final two targets would be $1 trillion increases, with the final goal being $8.5 trillion within 10 years.

Tesla would need to sustain these market cap goals for at least 30 days, and in some cases, trailing-six-month averages.

TSLA Market Cap data by YCharts.

Aside from the lofty market cap ambitions, the following operating milestones must be met:

- 20 million vehicles delivered

- 10 million paid Full Self-Driving (FSD) subscriptions

- 1 million Optimus robots delivered (starting from Sept. 3 of this year)

- 1 million driverless robotaxies in commercial service (based on 3-month average)

If any goals are not met by the end of the 10-year program, the associated awards will be forfeited.

Why is Tesla offering Musk such a huge package?

Tesla's current bread and butter is selling its electric vehicles, but that business has been struggling recently as it faces increased competition and falling volume. Its U.S. market share has fallen to its lowest level in eight years. This offer makes one thing clear: Tesla's board of directors wants Musk's sole focus on the company's robotics, autonomy, and artificial intelligence (AI) ambitions.

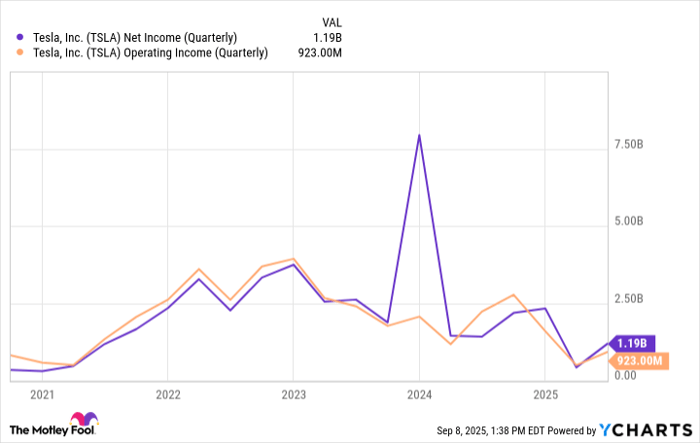

Selling cars is a notoriously low-margin business. However, software (which is the backbone of Tesla's ambitions) comes with much higher margins and better chances for recurring revenue. If Tesla can scale its FSD subscriptions, establish a viable robotaxi network, and secure a sizable market for its Optimus robots, it could experience a significant improvement in profitability.

TSLA Net Income (Quarterly) data by YCharts.

Having a revenue mix of car sales and high-margin software and services could dramatically transform Tesla's business for the better.

Will Tesla and Musk achieve these goals?

Anything is possible in the stock market (for better and worse), but Tesla increasing its market cap by more than 7.5 times its current valuation in 10 years would be monumental for a company of its size. And unfortunately, the stock market is irrational, meaning even if Tesla makes progress in autonomous and robotics, there's no guarantee it will lead to significant growth in its valuation, at least in the immediate aftermath of reaching those goals.

That said, with Musk's potential $1 trillion package aside, if Tesla does make progress in those areas, it sets its business up to be a huge force in the tech world for quite some time. Yes, Tesla may be a car company as it stands, but the signs have seemingly always pointed to it wanting to be more of a tech and AI platform than strictly an automaker.

I wouldn't take the offer as a guarantee, but it surely adds a lot of incentive for the company's head honcho to make it happen.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.