ASX exchange-traded funds (ETFs) have become increasingly popular with high-income earners in Australia.

They offer high earners broad market exposure and diversification without the hassle of managing a range of individual stocks and their individual fees. Essentially, ETF investors are able to buy a bunch of shares via a single trade and for one brokerage fee.

Not only that, but another upside is that many dividend-paying ASX ETFs pass on franking credits to investors. That means our highest-earning professionals, who face higher marginal tax rates, can use franking credits to reduce their tax liability.

So, which ASX ETFs are Australia's highest-earning professionals investing in?

The Financial Review, using Stockpot data, has collated a list of the most popular ASX ETFs. Here's what it revealed.

How top earners invest

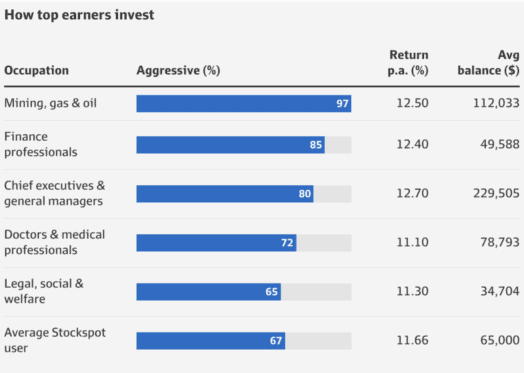

The analysis takes a snapshot of six of Australia's top-earning professions – mining, gas and oil professionals; finance professionals; chief executives and general managers; doctors and medical professionals; legal, social and welfare professionals; and the average Stockpot user.

The data shows that Australians who work in the mining, gas and oil sector have the highest investment risk appetites by occupation. Stockpot found that 97% of those professionals are invested in one of its 'aggressive' portfolios. These portfolios include growth and high-growth stocks.

This is compared to 85% of finance professionals who invest in the same portfolio, 80% of chief executives and general managers, 72% of doctors and medical professionals, and 65% of legal, social and welfare professionals.

For context, 67% of average Stockpot users also invest in the portfolio.

Source: Financial Review/Stockpot

The most popular ASX ETFs in Stockpot's 'aggressive' portfolio

Stockpot's aggressive-growth portfolio is made up of 78% growth assets, such as shares. It also comprises 22% of defensive assets such as gold, government and corporate bonds.

That portfolio, which is Stockspot's most popular, includes:

- Vanguard's Australian Shares Index ETF (ASX: VAS)

- iShares International Equity ETFs – iShares Global 100 ETF (ASX: IOO)

- MSCI emerging markets and core composite bonds such as Vanguard FTSE Emerging Markets Shares ETF (ASX: VGE) and iShares MSCI Emerging Markets ETF (ASX: IEM)

- Etfs Metal Securities Australia – Etfs Physical Gold (ASX: GOLD)

Stockpot's growth portfolio has similar ETFs, but a higher proportion (30%) in defensive assets.

Most traded ASX ETFs of FY25

Some of these ETFs also made the list of the most-traded ASX ETFs by Stake customers in FY25, highlighting their popularity across all types of investors.

Online trading platform Stake noted that for the financial year ending 30 June, the Vanguard Australian Shares Index ETF was the second most popular among all its customers, with an 81% buy to 19% sell ratio.

The Global X Physical Gold ETF also made the list with an 86% buy and 14% sell ratio.