This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia already returned more than $24 billion to shareholders through repurchases and dividends in the first half.

- In general, share repurchases could be seen as a sign of confidence or a poor use of cash.

Investors have rushed to buy Nvidia (NASDAQ: NVDA) stock during the artificial intelligence (AI) boom, driving the stock up a mind-boggling 1,200% over the past five years. Why are investors so excited about this one particular company? Because it's become the leading designer of AI chips and the general go-to destination for any customer with AI aspirations. Nvidia sells not only the world's top-performing chip but also a full range of AI offerings.

All of this has generated double- and triple-digit revenue growth, along with strong profitability on sales. And considering the projections for AI investment in the years to come and Nvidia's commitment to innovation, the company may continue to deliver significant earnings gains for quite some time. This has clearly given investors reason to be bullish about the company.

But investors aren't the only ones buying shares of Nvidia. The company itself has repurchased shares this year and has just announced an authorization to buy back $60 billion in stock at any point in the future. This is in addition to the more than $14 billion that remains on its share purchase authorization. Now, you may be wondering what Nvidia's interest in buying its own shares means for investors -- is this good or bad news? Let's find out.

Returning $24 billion to investors

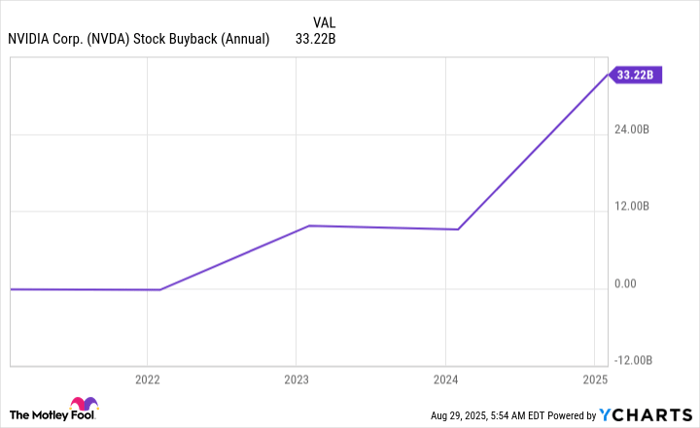

As mentioned, buybacks aren't a new thing for Nvidia. The company returned more than $24 billion to shareholders in the form of repurchases and dividends in the first half of the year. Over the years, Nvidia has increased its investments in its own shares, as you can see in the chart below.

NVDA Stock Buyback (Annual) data by YCharts.

And with Nvidia's latest move, it joined a wave of activity launched by a number of major tech and financial companies. Apple, Alphabet, and JPMorgan Chase have each announced billions of dollars in share repurchases this year, helping overall share repurchases for the year reach $1 trillion by August -- the fastest rate ever.

Buybacks should generally be viewed as positive, as they suggest management is confident in the company and how it's likely to perform in the economic environment. The move also removes some shares from circulation, boosting the value of the shares that remain on the market and compensating for dilution that may be caused by stock options granted to employees.

All of that is positive. But there is a negative side to the story, too. By lowering the number of outstanding shares, share repurchases boost a company's earnings per share. While this isn't necessarily bad, some investors may view buybacks as an attempt to make earnings look better than they actually are.

On top of this, some investors may prefer that a company invest more in research and development (R&D) or the expansion of its business rather than repurchasing shares. In these cases, a big stock repurchase plan could be bad news for shareholders.

AI infrastructure spending

Now, let's consider the case of Nvidia. Though the AI powerhouse's growth has slowed from triple digits to double digits in recent quarters, growth remains quite strong, and the long-term earnings outlook is solid. Nvidia predicts as much as $4 trillion in AI data center infrastructure spending this decade. And as a leading provider of chips and related products, Nvidia is likely to benefit from those investments from big tech companies and others. All of this means that Nvidia doesn't need to buy back shares to make its earnings per share look good.

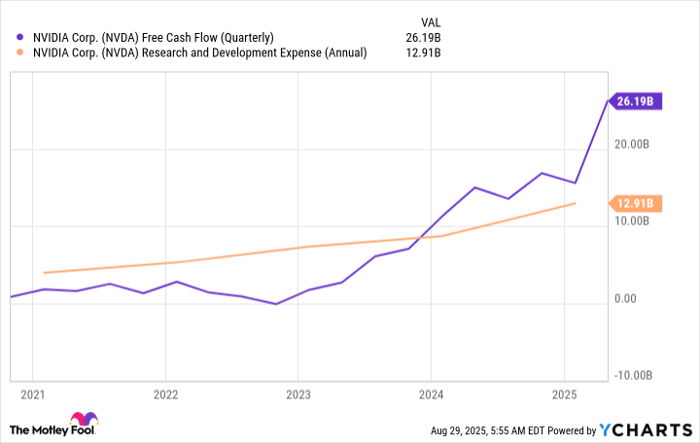

As for R&D, Nvidia has been increasing its investment over time, and today it's on track to update its chips on an annual basis as promised. The company launched its Blackwell architecture late last year, recently made the chip update Blackwell Ultra available, and the next-generation Rubin architecture is planned for release at some point next year. At the same time, free cash flow has been on the rise.

NVDA Free Cash Flow (Quarterly) data by YCharts.

All of this shows that Nvidia generates a great deal of cash and has been using it wisely to boost growth. The move to repurchase shares is unlikely to harm the company's ability to innovate and grow.

So, Nvidia's plan to repurchase as much as $60 billion in shares is far from negative for shareholders. Instead, it's a sign of confidence from the tech giant in its future and its ability to advance in today's economic environment and the ones to come. And that means that as Nvidia readies to buy some of its own shares, other investors should consider getting in on this top AI stock, too -- and, importantly, holding on for the long term.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.