This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

-

Berkshire Hathaway is the investment vehicle of Warren Buffett and his team.

-

The company's stock has vastly outperformed the broader market, thanks to the way in which Buffett invests.

-

Berkshire Hathaway is about to see a huge change in the way it's run.

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) is an interesting name. Today it represents the conglomerate that Warren Buffett built. But, before Buffett bought the company, it was a failing clothing business. That clothing business ultimately closed under Buffett's watch, representing one of his most prominent failed investments.

A long run of good investments has turned that failure into a huge success. However, in one year's time, there's going to be a very big change at Berkshire Hathaway.

What does Berkshire Hathaway do?

Berkshire Hathaway is a conglomerate. Conglomerates often operate in a few different business lines, sometimes with each business having its own brand identity. Berkshire Hathaway took that model and ran with it. At the end of 2024, Berkshire Hathaway had 189 subsidiary companies!

But that's not the whole story. That list of 189 companies includes a couple of large insurance businesses. Insurance companies collect insurance premiums up front and they pay out money to cover losses in the future. The premiums get invested until the cash is needed to fund payouts. This is what's known as "float" on Wall Street. Insurance companies can keep whatever they earn on the float.

Berkshire Hathaway has long invested the float in the stock market, with a large portfolio of stocks augmenting its owned businesses. Some of the company's long-term holdings include Coca-Cola (NYSE: KO), American Express (NYSE: AXP), and Chevron (NYSE: CVX). That diversity is replicated in the company's owned investments, in a wide-ranging investment portfolio.

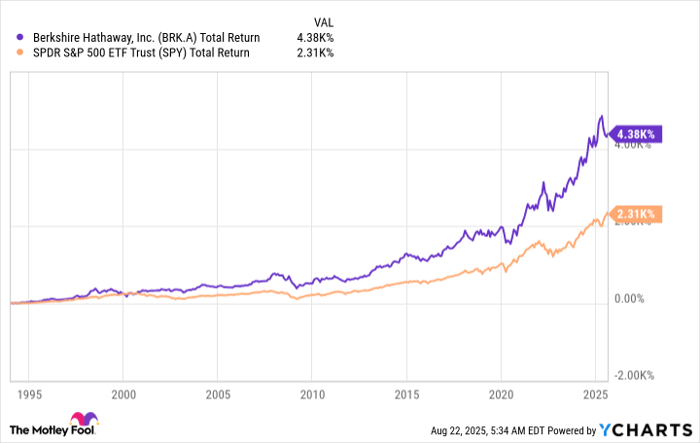

Essentially, Berkshire Hathaway is something like a mutual fund. When you buy the stock, you are, effectively, investing alongside CEO Warren Buffett. As the chart below highlights, doing so has worked out very well for investors over the long term.

BRK.A Total Return Level data by YCharts.

Things are about to change at Berkshire Hathaway

So, from a big-picture perspective, buying Berkshire Hathaway is really buying into Buffett's investment approach. To briefly summarize that approach, Buffett likes to buy well-run companies while they are attractively valued and then hold them for the long term to benefit from the growth of their businesses. Simple to say, hard to do. Yet, clearly, Buffett has executed his investment approach incredibly well over time.

At the end of 2025, he is going to retire as CEO of Berkshire Hathaway, handing the reins to Greg Abel. Since Abel isn't Buffett, the company will inherently be different one year from now. The question is: How different?

The good news on this front is that Buffett isn't cutting and running. He is slated to remain as the chairman of the board of directors. So Abel is, technically, still Buffett's employee. Buffett generally takes a hands-off approach, but if Abel is struggling, it's likely Buffett will step in to help.

There's also the fact that Abel has worked for Berkshire for over two decades. So he is steeped in the Oracle of Omaha's approach. Because he is a different person, there will inherently be differences in the way he approaches the CEO role. But given his long association with such a successful CEO, it also seems likely that he will try his best to heavily incorporate Warren Buffett's teachings into whatever he does.

Different, but not that different

As an investor, if you're worried that Buffett stepping down will lead to Berkshire Hathaway dramatically changing the way it is run, that's probably not going to happen. Still, the CEO change is material, so investors should keep a regular eye on the business. The company will be different in an important way in a year, with Abel stepping in to fill Buffett's very large shoes. But the basic approach taken at the top of the company probably won't be so different that Berkshire Hathaway will become a completely different company overnight.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.