This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investors may not think of Netflix (NASDAQ: NFLX) as the hot growth stock it was a decade ago, but the stock has been on a warpath over the last few years, despite the broader perception that it's a mature company.

After the stock tumbled in 2022, following two straight quarters of subscriber declines, the company went back to the drawing board, launching an advertising tier after years of saying it wouldn't. It also cracked down on password-sharing and experimented with live events, like sports.

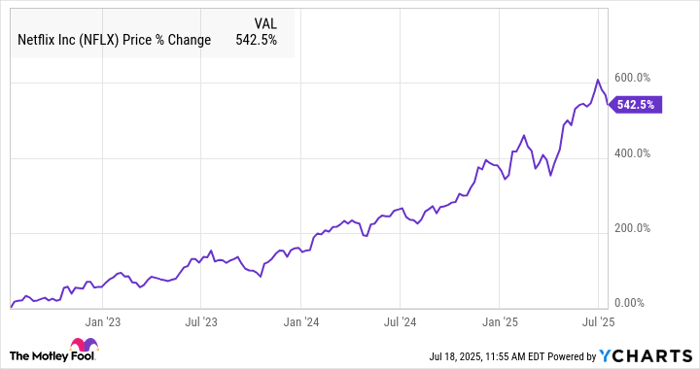

As a result, the stock has skyrocketed, gaining more than 500% over the last three years as the chart below shows.

Netflix isn't going to repeat that feat over the next three years, at least without a major new expansion of the business, but a double seems like a reasonable goal. Can it get there? Investors just got some clues in its latest earnings report.

Q2 was a hit with viewers, but not investors

Netflix stock slipped 5% on the second-quarter report on Friday. The numbers were strong, but the recent surge in the share price has raised expectations for the company. Revenue was up 16% to $11.1 billion, marking its fastest growth rate in four quarters, but the result essentially matched estimates.

The streamer stopped reporting subscriber counts, so it's not as easy to see what's driving the business growth. Management said it was driven by a combination of subscriber additions, growth in the ad business, and price hikes in markets like North America. The company is now using its proprietary ad tech platform, Netflix Ads Suite, in all of its markets, showing it's rapidly embraced advertising as part of the core driver of its business.

Thanks to its subscription business model, the company's profit margin continues to expand as the business grows, and the ad business is likely contributing to margin growth as it's allowed the company to monetize its content in a new way and attract budget-conscious subscribers who didn't want to pay for the ad-free tier. Operating margin expanded from 27.2% in the quarter a year ago to 34.1%, and earnings per share (EPS) jumped from $4.88 to $7.19, beating the consensus at $7.06.

Management warned that margins would fall in the second half of the year as content expenses grew. Its third-quarter guidance, for example, called for 31.5% operating margin, but the company also raised its full-year guidance from $43.5 billion-$44.5 billion to $44.8 billion-$45.2 billion. It now sees currency-neutral operating margin expanding to 29.5%, up from a previous forecast at 29%.

The business seems to be firing on all cylinders as the ad engine takes off. Netflix continues to expand the breadth of its content with several series and films bringing audiences of 50 million or more in the quarter.

Members watched 95 billion hours in the first half of the year, a 1% increase, and the company's local content strategy is paying off, as well, as non-English content now represents more than a third of its viewing. Those trends all bode well for the business over the next three years.

Can Netflix stock get to $2,500?

Netflix's surge over the last three years is primarily due to the improvements in the business, but it's also benefited from multiple expansion. You can see that in the chart below, though that doesn't include the most recent quarter.

Factoring in second-quarter earnings, Netflix's price-to-earnings ratio (P/E) would be closer to 50, but that's still pricey, especially for a stock that was regarded as mature not long ago.

For Netflix to double from here, it will likely have to earn it on its own merits, as Friday's post-earnings sell-off shows, despite the strong results. Investors seem to feel the stock now has enough growth baked in, which makes further gains more difficult.

Netflix can double earnings per share, but it may take more than three years to do it. Still, with its double-digit revenue, expanding operating margins, and potential to expand into new businesses, doubling EPS in the next five years seems like a fair assumption.

The streaming stock could double by 2028 but will have to top an already high bar. That won't be easy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.