More than three decades ago, Warren Buffett famously remarked that his favourite holding period is forever.

Long-term investing typically involves a holding period of at least five years. This allows an investment thesis to play out over several years. Over that period, investors hope to see share prices generally trend in the right direction while accepting short-term volatility.

While most investors claim to be long-term investors, very few actually practice this. According to A Wealth of Common Sense, the average holding period for an individual stock in the US is just 10 months. For US mutual funds, it is slightly longer, at two and a half years. Back in the 1960s, the average holding period was eight years.

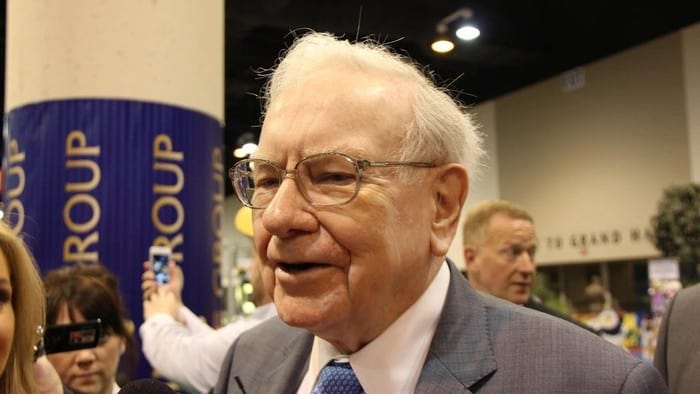

Legendary investor and Chairman of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Warren Buffett, prefers a different timeframe.

In Berkshire's 1988 annual letter to shareholders, Buffett wrote:

When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint.

Buffett's two longest holdings are Coca-Cola (NYSE: KO), which he's held since 1988, and American Express (NYSE: AXP), which he first purchased in 1991. In Berkshire's 2023 letter to shareholders, Buffett outlined eight holdings that he considered indefinite. Both Coca-Cola and American Express made that list.

What's the catch?

While Buffett prefers to hold his investments forever, he's never shied away from selling a stock to correct a mistake. Sometimes, that even means selling it within a few months of it being purchased.

In Q4 2024, Berkshire exited its position in US beauty retailer Ulta Beauty Inc (NASDAQ: ULTA) after buying it just two quarters prior.

In Berkshire's 1988 annual letter to shareholders, Buffett wrote:

We continue to concentrate our investments in a very few companies that we try to understand well. There are only a handful of businesses about which we have strong long-term convictions.Therefore, when we find such a business, we want to participate in a meaningful way. We agree with Mae West: "Too much of a good thing can be wonderful."

In 2006, Berkshire revealed that 30% of its stocks are sold within 6 months and just 20% are held for more than 2 years.

Evidently, Buffett is very selective, with very few businesses making the cut as infinite holdings.

Foolish Takeaway

Warren Buffett is widely regarded as the best investor in history. In an effort to replicate his success, countless investors have adopted his investment strategies.

Buffett prefers to hold stocks forever. However, based on Berkshire's history, this is more aspirational than reality. Instead, very few companies make the cut. Buffett's not afraid to rapidly correct his investing mistakes by selling.

Investors looking to replicate Buffett's strategy should seek out the highest-quality investments, maintain strict standards, and not be afraid to reverse course if necessary.