S&P/ASX 200 Index (ASX: XJO) gold stock Newmont Corp (ASX: NEM) is still a relative newcomer to the ASX.

Shares in the United States-listed gold mining giant first began on the ASX on 27 October 2023.

That followed Newmont's successful acquisition of ASX-listed Newcrest Mining. Following that acquisition, Newmont now produces around six million ounces of the yellow metal every year, earning it the honorific spot as the world's top gold producer.

At Thursday's closing price of $74.44 a share, the ASX 200 gold stock also commands an impressive market cap of $83.89 billion.

However, according to investment manager Firetrail, Newmont shares remain significantly undervalued at current levels.

An undervalued ASX 200 gold stock

Newmont counts among the handful of stocks Firetrail's Australian High Conviction Fund is overweight in.

In the fund's January update, Firetrail says it continues to invest in "undervalued companies with defensive attributes, including Newmont".

Part of the appeal of this ASX 200 gold stock is based on the strong march higher in the gold price and forecasts of further gains to come.

According to Firetrail:

While news flow on Trump, tariffs and AI buffeted a number of sectors during January, one area of the market that continued to march higher was gold.

The USD gold price rose another 7% to hit record levels. While gold mining stocks have followed, we believe there is more to come.

And Firetrail believes that Newmont shares have some catching up to do with the soaring gold price.

The investment manager said:

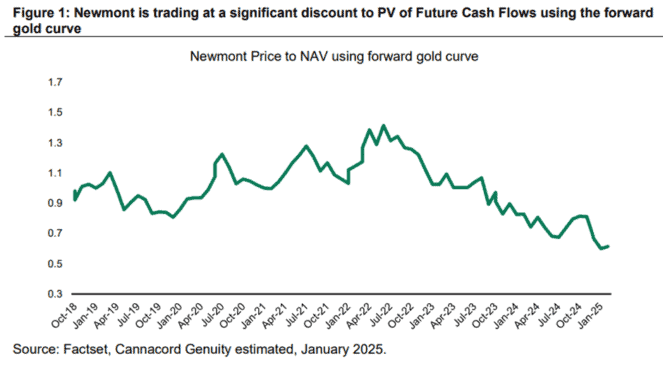

Based on the current forward curve for gold, Newmont is trading at a 35% discount to the present value of its future cash flows.

Put simply, if the market was to pay a valuation more in line with its historic average (i.e. 1.0x NAV), Newmont's share price would rise by more than 50%.

Firetrail provided the following chart to highlight their case:

Looking ahead, Firetrail said, "We continue to like the gold sector."

What's been happening with the gold price?

Newmont and most ASX 200 gold stocks have been enjoying strong tailwinds as the gold price continues to smash into new all-time highs.

Bullion has seen strong ongoing demand from global central banks and has benefited from lower interest rates in the United States and much of the developed world. As gold pays no yield itself, it tends to perform better in low or falling interest rate environments.

Ongoing global uncertainty has also fuelled gold demand the world over, with bullion classically seen as a haven asset in times of turmoil.

On Thursday afternoon, gold was trading within a whisker of a new record high at US$2,916.56 per ounce. That sees the yellow metal up 11% already in 2025 and up more than 44% since this time last year.

As you'd expect, this has been great news for investors in gold producers like Newmont.

In the last 12 months the S&P/ASX All Ordinaries Gold Index (ASX: XGD) – which also contains some smaller miners outside of ASX 200 gold stocks – has surged 57.1%.

Newmont shares are up 44.9% over this same period.