This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Perhaps no stock exemplified the past year's artificial intelligence (AI) frenzy more than Nvidia (NASDAQ: NVDA). The semiconductor chipmaker's business benefitted as tech companies spent billions of dollars to buy its AI offerings. Shares of Nvidia were up nearly 90% over the past 12 months through the end of January.

But when Chinese start-up DeepSeek announced on January 27 it produced a large language model (LLM) for less than $6 million, a fraction of the money spent by U.S. companies, Nvidia shares plunged 17%. The stock since recovered, but it's still below the 52-week high of $153.13 reached on January 7.

Does this create a buying opportunity? Or is DeepSeek threatening to upend Nvidia's future earnings? Read on to learn if Nvidia remains a worthwhile long-term investment in AI.

Does DeepSeek's arrival threaten Nvidia's business?

DeepSeek's AI price tag was shockingly low, prompting concerns that Nvidia will lose business. If one company were able to produce the AI technology inexpensively, others could do so without Nvidia's pricey products.

But the Chinese start-up's success is unlikely to impact Nvidia in a substantial way for several reasons. For starters, it's possible DeepSeek used restricted advanced AI chips. The U.S. Commerce Department is investigating that possibility.

In addition, ChatGPT creator OpenAI accused DeepSeek of stealing OpenAI's data to make its software. AI requires mountains of data to perform tasks, so if DeepSeek inappropriately used OpenAI's content, that's another reason others may not be able to replicate LLMs on the cheap.

Moreover, the U.S. is in a battle with China for digital supremacy. This led to export restrictions on the sale of AI chips to China. After DeepSeek's arrival, more restrictions may be coming, which would make it challenging for other Chinese companies to develop low-cost LLMs.

The U.S.-China rivalry may also result in DeepSeek being banned. The DeepSeek AI technology is already barred by federal agencies such as the U.S. Navy and NASA.

The U.S. passed a law banning another Chinese company, TikTok, over privacy and security concerns. President Donald Trump paused the ban's implementation, but eventually it will happen unless Congress reverses it or TikTok is sold to a U.S. business. Given how much AI relies on data to function, banning DeepSeek and other Chinese AI companies makes more sense than banning TikTok.

A U.S. ban is not the only possibility. Italy banned DeepSeek at the time of this writing. Such actions by other nations would curb AI competition from China.

Nvidia's many strengths

These factors indicate Trump's recently announced Stargate project, which calls for up to half a trillion dollars in AI infrastructure investment, will proceed as planned. Nvidia is one of the companies working on the project.

Nvidia CEO Jensen Huang met with Trump on January 31 to discuss AI policy. That level of access and input into U.S. AI strategy means Nvidia is positioned to benefit as policies evolve.

After all, Nvidia is already seen as the preeminent AI chip provider. Its reputation helped it achieve record revenue of $35.1 billion in its fiscal third quarter, ended October 27, 2024. This represents an impressive 94% increase from a year ago.

On top of its revenue growth, the company's other financials are outstanding, illustrating its strong underlying business. Its Q3 net income of $19.3 billion was a 109% increase from the prior year. Its Q3 balance sheet contained $96 billion in total assets, including $38.5 billion in cash, cash equivalents, and investments. Nvidia's cash hoard alone is greater than its Q3 total liabilities of $30 billion.

Adding to this, the chipmaker's latest computing architecture, Blackwell, is selling well. CFO Colette Kress said on the earnings call, "We are on track to exceed our previous Blackwell revenue estimate of several billion dollars."

The company is also more than an AI company. Its chips are used in other industries, such as in robotics, PCs, gaming consoles, and the automotive sector as cars increasingly add more digital capabilities.

To buy or not to buy Nvidia stock

Nvidia's strong financials and revenue growth, the popularity of its products, and the diverse range of applications for its chips put the company in a position to prosper for years to come, making its stock an excellent long-term AI investment. And now is a good time to buy shares.

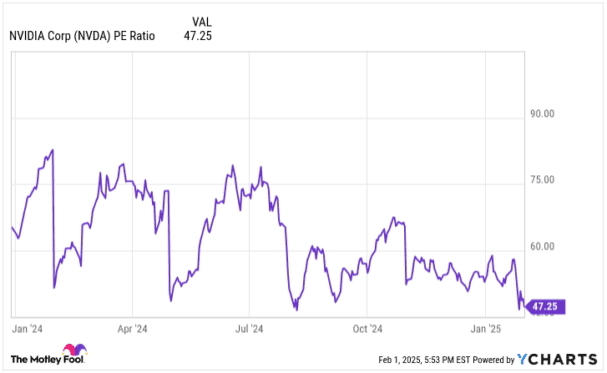

That's because of Nvidia's stock valuation. Here's a look at its price-to-earnings (P/E) ratio, which tells you how much investors are willing to pay for a dollar's worth of earnings.

Data by YCharts.

Nvidia's P/E multiple is on the low end of where it's been over the past year at the time of this writing. This indicates the company's shares are reasonably priced compared to the past.

Its stock valuation adds to its strong business, making now a good time to scoop up shares of this leading AI chipmaker ahead of its fiscal Q4 earnings report on February 26.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.