One year ago, on 15 January 2024, you could have bought ResMed Inc (ASX: RMD) shares for $26.00 apiece.

In intraday trade today, shares in the S&P/ASX 200 Index (ASX: XJO) sleep disorder treatment company are changing hands $36.92 each. That sees the ASX 200 healthcare stock up 42% over 12 months. Or almost four times the 10.1% gains posted by the ASX 200 over this same period.

And that's not even including the 21.4 cents a share in unfranked dividends ResMed paid out over the year.

But with those outsized gains already come and gone, can the healthcare company keep on delivering in 2025?

According to the investing pros at Firetrail, that's very possible.

Why ResMed shares can keep charging ahead in 2025

In Firetrail's December High Conviction Fund update, the investment manager reported it had an overweight holding of ResMed shares, with the ASX 200 healthcare stock counting among the top contributors to its returns.

Firetrail noted that 2024 saw a marked turnaround for ResMed after the stock came under selling pressure in 2023 amid investor jitters over the fast rise of GLP1 drugs, which are used to help manage diabetes and obesity.

"It was back in August 2023 that concerns around the impact of GLP1 drugs drove a swift and aggressive selloff in ResMed shares," Firetrail said.

The fund manager continued:

Indeed, ResMed was among the largest detractors for the High Conviction Fund in 2023. However, throughout 2024 our bottom-up conviction and patience were rewarded as ResMed shares outperformed the ASX 200 by 35%.

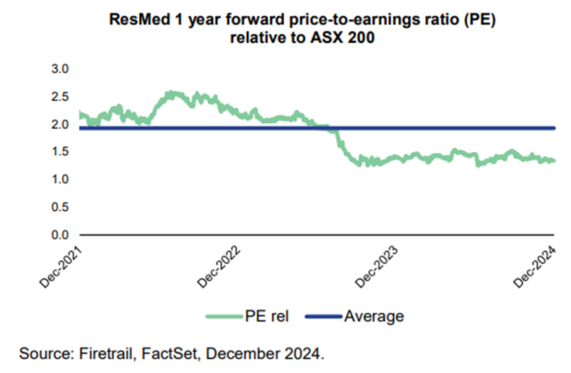

In their bullish assessment for the outlook of ResMed stock in 2025, Firetrail's analysts pointed to a divergence in the company's price to earnings (P/E) ratio.

"Despite a more balanced emerging view on the impacts of GLP1s, ResMed's relative PE multiple has not recovered since the initial August 2023 selloff," Firetrail said.

Firetrail added:

ResMed's share price rise in 2024 has been entirely driven by earnings revisions. Consensus FY 2025 earnings per share (EPS) in Aussie dollars is now 26% higher than it was at the start of the year, driven by strong continued revenue growth and a recovery of gross margins.

The fund manager included the below graph to illustrate the divergence.

Summing up their optimistic outlook for ResMed shares in 2025, Firetrail said:

While the debate over the ultimate impact of GLP1s remains dynamic, we continue to see earnings upside for ResMed supported by a dominant market position and increased awareness of sleep apnoea.