This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Since artificial intelligence (AI) emerged as the capital market's next big obsession a couple of years ago, the term 'Magnificent Seven' began to gain steam. That name is used to collectively describe the world's largest technology businesses, each of which is carving out a unique pocket within the broader AI market.

Here are the returns of each Magnificent Seven stock in 2024:

- Nvidia: 171%

- Meta Platforms: 65%

- Tesla: 62%

- Amazon (NASDAQ: AMZN): 44%

- Alphabet: 35%

- Apple: 30%

- Microsoft: 12%

With the exception of Microsoft, each of these mega-cap tech stocks outperformed the S&P 500 and Nasdaq Composite market indices last year. Despite these market-beating returns, I see one Magnificent Seven stock as the superior opportunity.

Below, I'll reveal my pick for the top Magnificent Seven stock and make a case for why I think this company will emerge as one of AI's most lucrative opportunities in the long run.

Amazon looks primed to thrive

Semiconductor stocks like Nvidia are all the rage right now, and it's nearly impossible not to see headlines or financial programs covering self-driving cars or humanoid robotics, two Tesla specialties.

But when it comes to mega-cap technology stocks, my top pick is e-commerce and cloud computing juggernaut Amazon.

Over the last couple of years, Amazon has quietly built an AI ecosystem worth paying attention to. It all started with a $4 billion investment in an AI start-up called Anthropic, whose large language model (LLM) Claude is seen as one of ChatGPT's biggest sources of competition. Following its initial investment, Amazon ploughed another $4 billion into Anthropic in November -- bringing its total funding into the start-up to $8 billion.

The main tailwind that Anthropic provides is that it uses Amazon's Trainium and Inferentia chips to train its generative AI models. Anthropic also relies heavily on Amazon's cloud segment, Amazon Web Services (AWS).

This partnership has been incredibly savvy for Amazon, and it's all seen in the numbers. Over the last several quarters, revenue from AWS has accelerated considerably and, more importantly, so have operating profits.

This dynamic has yielded lots of free cash flow for Amazon, which the company is using to double down on its AI investments by building data centres and ratcheting up its internal chip infrastructure.

AI can be transformative for Amazon

AI represents a catalyst of sorts for many businesses, but I'd argue that its potential has some sort of measurable ceiling. What I mean is that AI may be a channel that helps sell more software or leads to more user engagement across social media platforms, depending on the specific end market for the business in question.

Amazon has the potential to leverage AI across its e-commerce marketplace, AWS, grocery delivery services, streaming, advertising, and so much more. The company operates across such a large ecosystem, I find it hard to buy into the idea that AI has reached maturity or will become a product of diminishing returns for Amazon.

I think this is doubly true, considering that the majority of Amazon's major product offerings are geared to keep users and customers sticky and returning to the platform.

A stock so cheap, it can't be ignored

The one aspect of investing in Amazon that can be a little tricky is valuation. Given how vulnerable its biggest businesses (cloud computing and e-commerce) are to the wider economy, Amazon tends to have notable volatility in its net income.

However, for some businesses, I prefer to look past net income altogether and focus more on adjusted measures such as free cash flow, which I see as a more accurate representation of Amazon's profitability, no matter what the economy looks like.

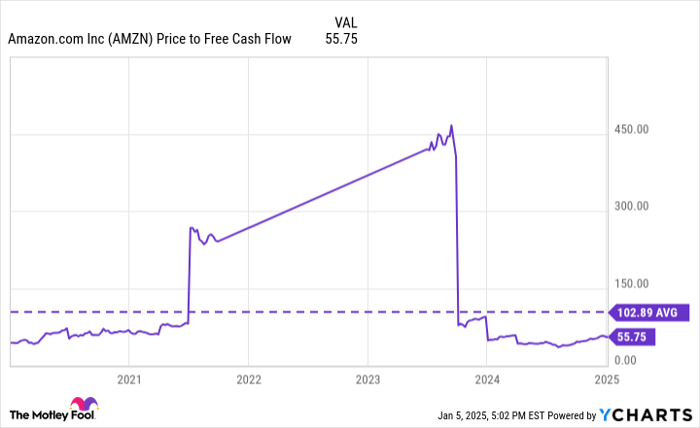

For the trailing 12-month period ended September 30, Amazon's free cash flow soared by 123% to $47.7 billion. And yet, if you look at the valuation trends below, this growth doesn't appear to be priced into the shares at all.

AMZN price-to-free-cash-flow data by YCharts.

The company's price-to-free-cash-flow multiple (P/FCF) of 55.7 is about half of its five-year average. I think investors are spooked by Amazon's rising capital expenditures (capex) in chips, data centres, and cloud infrastructure. In turn, this is causing a high degree of scepticism over how these AI ambitions will pay off.

To me, these concerns are unwarranted. As I mentioned above, Amazon's partnership with Anthropic is already resulting in rising sales and profits for AWS, which is providing the company with the necessary financial horsepower to make more AI-related investments.

Furthermore, given the potential AI has to transform the entire business, it's surprising to see the company trading at such a steep discount relative to historical levels. At the end of the day, I see Amazon as the most compelling opportunity among the Magnificent Seven, and at its current bargain price, I would buy shares ASAP and prepare to hold on for dear life.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.