Whoever thought big and boring couldn't beat the market was dead wrong. Westpac Banking Corp (ASX: WBC) shares have wiped the floor with the benchmark index, giving its investors nearly 40% more than the S&P/ASX 200 Index (ASX: XJO) over the last 12 months.

The rally coincides with a full year of the Reserve Bank of Australia's cash rate holding above 4%, giving banks the wiggle room for thicker interest margins. At the same time, the Aussie economy has persevered, dodging a recession to date — another win for lenders' bottom lines.

But with rate cuts expected in 2025, could the Westpac share price soon leave investors red-faced?

Are Westpac shares set to break records?

The Westpac share price needs to blast past $39.64 to set a new all-time high. In today's afternoon trading, shares in the country's third-largest bank by market capitalisation are swapping hands for $33.83, that's only 17% shy of uncharted territory.

In a way, Westpac is already setting records. Today's share price is the highest the bank has seen in seven years and seven months. However, the rapid nature of the gains summons that little voice in the back of one's head that beckons, "Is this too good to be true?"

Analysts at UBS are unconvinced that Westpac shares' jolly good days are over. The UBS team has given the Big Four bank a buy rating and a price target of $37. While that still falls short of the all-time high barrier, it still suggests another 9%-ish upside before dividends.

Before getting too excited, not all forecasts for Westpac are red and rosy. On the other side of the coin is the wealth management and brokerage firm Morgans. Unlike UBS, Morgans has downgraded Westpac and believes the share price could slip to $27.77, implying an 18% downside from here.

Where does Westpac rank among the Big Four?

What if we take a relative view of Westpac's valuation?

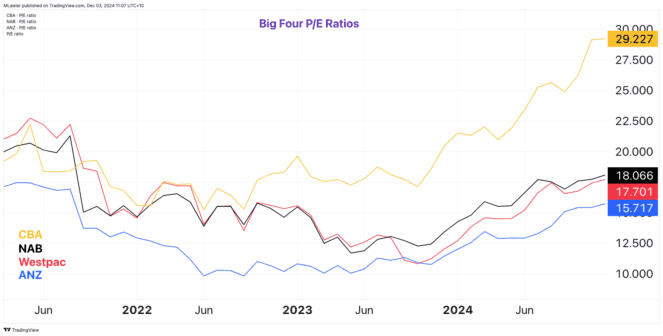

The banking major trades on a price-to-earnings (P/E) ratio of 17.7 times earnings. As the chart below shows, this is roughly in the same ballpark as its peers ANZ Group Holdings Ltd (ASX: ANZ) and National Australia Bank Ltd (ASX: NAB), whereas Commonwealth Bank of Australia (ASX: CBA) shares are a whole other beast.

If — it's a big if — Westpac were to attract the same premium as CBA, we'd be looking at a share price in the realm of $59 (all else being equal). That would mean another 74% capital appreciation still sitting on the table.

There's a big caveat, though.

When taking a relative approach to valuing a business, it's hard to know whether the yardstick — CBA in this case — is reasonably valued itself.

Nevertheless, anyone who has held Westpac shares over the last year is probably not too fussed about trying to replicate 50%-plus returns over the next year. If Westpac did rally another 59%, the bank would reach a market capitalisation of $184 billion, overtaking NAB and CSL Limited (ASX: CSL).