ASX lithium stock Piedmont Lithium Inc (ASX: PLL) shot 13.9% higher to 20.5 cents per share at the market open on Tuesday following the release of the company's 3Q FY24 results.

The Piedmont share price is currently trading at 20 cents per share, up 11.1%.

Let's check out the report.

ASX lithium stock rips 14% on record production news

Piedmont is a part owner of the North American Lithium (NAL) project, which is North America's largest producing spodumene mine. It is located in the Carolina Tin Spodumene Belt of North Carolina.

Piedmont owns 25% of NAL, while its partner, Sayona Mining Limited (ASX: SYA), owns 75%.

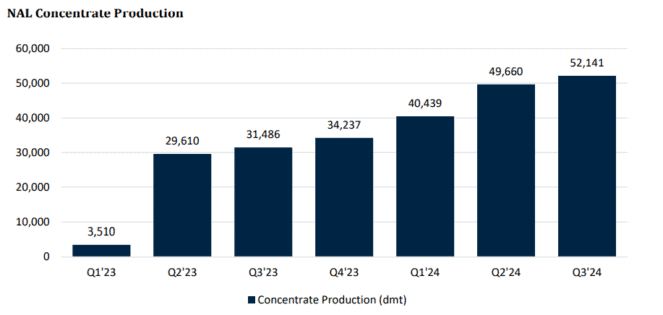

According to the report, the NAL produced a record 52,141 dmt of spodumene lithium concentrate in 3Q FY24, a 5% increase from the previous quarter.

In total, 48,992 dmt of lithium concentrate was shipped. Approximately 31,500 dmt of that was sold to Piedmont and shipped to its customers. The average grade was about 5.4% Li2O.

What else happened during the quarter?

Mill utilisation rose to a record high of 91% for the quarter, largely due to the availability of the recently completed crushed ore dome. The lithium recovery rate was 67%.

The company said the increased utilisation rate resulted in a 15% quarter-over-quarter reduction in unit operating costs (when excluding the impact of inventory movements).

Piedmont is targeting shipments of approximately 55,000 dmt of spodumene concentrate in the next quarter and total shipments of approximately 116,000 dmt for 2024.

Its previous annual guidance was 126,000 dmt. However, the company explained that it has rescheduled a planned cargo for Q4 FY24 to early Q1 FY25 following a customer's request.

Piedmont said:

While this single cargo push into early 2025 will cause a nominal adjustment from our prior guidance of 126,000 dmt for 2024, we expect this shift to be accretive to our 2025 shipments totals and does not impact Piedmont's total offtake quantities at NAL.

The company released a graph showing how production has changed since 1Q FY23.

What did management say?

Keith Phillips, President and CEO of Piedmont Lithium, said:

Operational performance continues to improve on a quarterly basis and Sayona's recent announcement of the increase to the Mineral Resource Estimate lays the foundation for a potential growth at NAL in the future.

What's next?

Piedmont hopes to become one of North America's largest lithium hydroxide producers for electric vehicle manufacturing by processing spodumene concentrate mined at its assets around the world.

The company's other assets include a mine in Quebec owned in partnership with Sayona and a mine in Ghana owned in partnership with Atlantic Lithium Ltd (ASX: A11).

ASX lithium stock price snapshot

Piedmont Lithium shares are down by 51% in the year to date and down 55% over the past 12 months.

Piedmont's partner in the NAL project, Sayona Mining, is also having a rough year in terms of share price.

Sayona Mining shares are down 50% in the year to date and down 56% over the past 12 months.

This compares to an 8% rise in the S&P/ASX All Ordinaries Index (ASX: XAO) in the year to date and a 22% increase over the past 12 months.