This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Billionaire investor Philippe Laffont is the founder of Coatue Management, one of Wall Street's most prestigious hedge funds. Below, I'll explore some of the more interesting moves Coatue has made recently regarding the firm's artificial intelligence (AI) positions.

To locate this information, I've reviewed the firm's Form 13F form. It's an incredibly useful tool for curious investors because it provides a detailed account of buying and selling activity by institutional investors every quarter.

Coatue Management's interesting move

During the second quarter, Coatue purchased 1.1 million shares of chip stock Taiwan Semiconductor Manufacturing (NYSE: TSM) -- increasing its stake by 10% and bringing its total position to 11.4 million shares.

On the surface, this may seem like a mundane or obvious move. After all, semiconductor stocks have been some of the biggest winners since the AI revolution kicked off a couple of years ago. But here's where things get a little curious -- check out the table below, and see how Coatue has been treating Nvidia stock.

| Category | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 |

| Nvidia Shares Held | 46.5 million | 45.4 million | 43.2 million | 13.9 million | 13.8 million |

For the past year, Coatue has been a net seller of Nvidia stock. All the while, the fund has nearly doubled its stake in Taiwan Semiconductor (also known as TSMC), increasing its position from 6.8 million shares at the end of the second quarter of 2023 to more than 11 million shares currently.

Why TSMC may be more attractive than Nvidia

On the surface, selling Nvidia stock right now might seem counterintuitive. The company is at the forefront of the AI movement, thanks, in large part, to its blossoming graphics processing units (GPU) business and data centre services. Moreover, with Nvidia's new Blackwell series GPUs projected to be yet another home run for the company, why would anyone even consider selling the stock right now?

In my opinion, the answer revolves around the long-term narrative. Many of Nvidia's largest customers -- such as Microsoft, Amazon, Alphabet, Meta Platforms, and Tesla -- are all investing heavily in their own AI infrastructures.

While many of these companies will probably remain core customers of Nvidia, there's a reasonable argument that the company's rocket-ship-style growth will experience some turbulence as new chipsets hit the market.

It's this very construct, however, that could bode well for Taiwan Semiconductor. The company already manufactures products for Amazon, Nvidia, Advanced Micro Devices, Intel, Broadcom, Sony, Qualcomm, and many more.

Despite Nvidia's strong influence on the current shape of the GPU market, Taiwan Semiconductor's diversified platform looks better positioned further down the road, as more hardware products are introduced. I think of TSMC as similar to a long-term call option on the need for AI-powered chips. The company is in a position to benefit, regardless of which company's GPUs are witnessing the most demand.

Is Taiwan Semiconductor stock a buy right now?

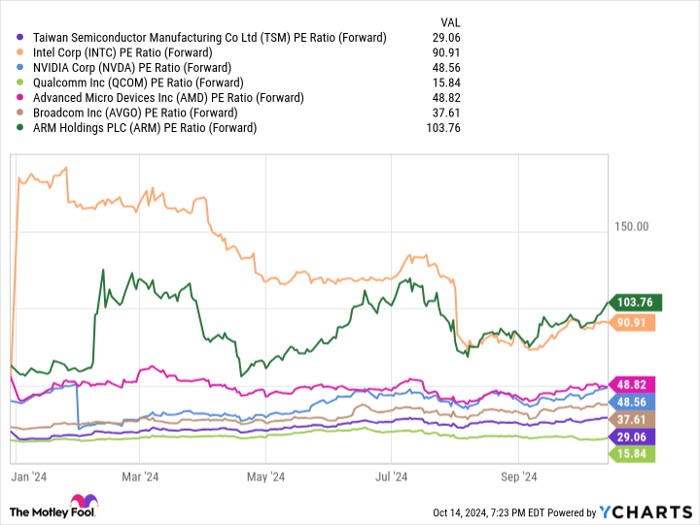

The chart below benchmarks TSMC stock against a peer set of other leading semiconductor players on a forward price-to-earnings (P/E) basis.

TSM PE Ratio (Forward) data by YCharts.

With a forward P/E of 29.1, Taiwan Semiconductor is among the least expensive in this cohort. That's pretty interesting, considering that its shares have surged by 112% over the past 12 months.

In other words, even with some considerable valuation expansion in a short time frame, Taiwan Semiconductor's outlook doesn't seem to be fetching a commensurate multiple compared to some of its high-growth peers.

Coatue is making appropriate moves regarding chip stocks. The firm has locked in some gains by reducing its Nvidia stake, yet it also stands to continue benefiting from any upside as long as it retains a position in some capacity.

Meanwhile, by continuing to bolster its position in Taiwan Semiconductor, Coatue appears to be making a savvy move right now. It could wind up being an even more lucrative decision as the AI narrative takes shape over time.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.