This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Warren Buffett took control of Berkshire Hathaway in 1965, and its Class A share price has since increased 5,500,000%. Meanwhile, the S&P 500 has returned 38,400%. Inspired by that outperformance, many investors carefully track the stocks Buffett buys and sells using the Forms 13F filed quarterly by Berkshire.

With that in mind, the company's stock purchases totalled $4.3 billion and its stock sales totalled $97.1 billion in the first half of 2024. That means Berkshire's net stock sales reached a record $93 billion through the June quarter. On the surface, that $93 billion warning signals a lack of buying opportunities in the current market environment, which itself hints at a possible drawdown.

That conclusion is further supported by the fact that Berkshire had $277 billion in cash and U.S. Treasuries on its balance sheet as of the June quarter, another record for the company. Finally, Buffett repurchased a mere $345 million in Berkshire stock during the June quarter, which marks his smallest allocation to stock buybacks in six years.

All of those clues point to an overvalued market, but the S&P 500 has historically delivered robust returns during the 12 months following years in which Berkshire Hathaway was a net seller of stocks. Here's what investors should know.

Warren Buffett's 'warnings' have often preceded large gains in the S&P 500

Since 2010, Warren Buffett's Berkshire Hathaway has been a net seller of stocks — meaning the total value of its equity security sales exceeded the total value of its equity security purchases — in seven years. In some cases, those events foreshadowed below-average returns in the S&P 500 in the subsequent year. But more often than not, the opposite was true.

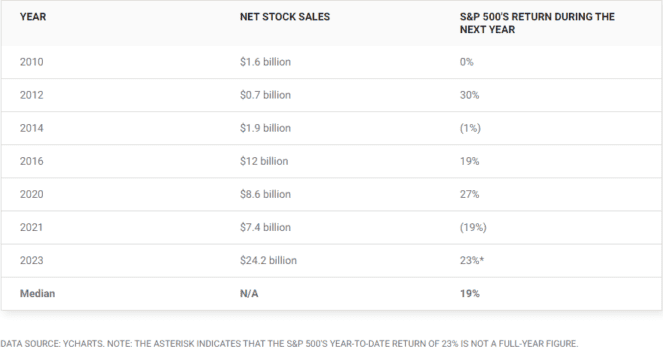

The chart below shows (1) each year in which Berkshire was a net seller of stocks, (2) the total value of the stocks sold by Berkshire during the year, and (3) the S&P 500's return in the next year. For instance, Berkshire's net equity security sales totalled $1.6 billion in 2010, and the S&P 500 returned 0% in 2011.

As shown above, since 2010, the S&P 500 has returned a median of 19% during the 12-month period following years in which Berkshire Hathaway was a net seller of stocks. But we need to consider the other side of the situation to truly appreciate what Buffett's $93 billion warning might mean for the S&P 500 in 2025.

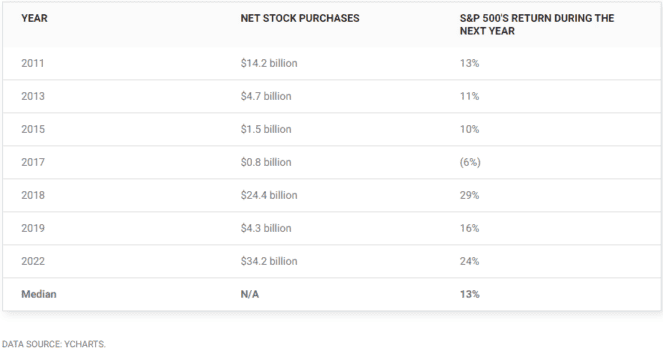

The chart below shows (1) each year in which Berkshire was a net buyer of stocks, (2) the total value of stocks purchased by Berkshire during the year, and (3) the S&P 500's return in the subsequent year. For instance, Berkshire's net stock purchases totalled $14.2 billion in 2011, and the S&P 500 gained 13% in 2012.

As shown above, since 2010, the S&P 500 has returned a median of 13% during the 12-month period following years in which Berkshire was a net buyer of stocks. That means the index has actually performed better after years in which Berkshire was a net seller.

With that in mind, assuming Berkshire is still a net seller when the year ends, history says the S&P 500 will advance 19% in 2025. Of course, past performance is never a guarantee of future results, but that statistic should give investors pause. It would be nonsensical to avoid the market (or sell stocks) simply because Berkshire Hathaway was a net seller through the first half of 2024.

How investors should interpret Warren Buffett's $93 billion warning

Berkshire Hathaway's GAAP net worth, also known as book value, currently stands at $602 billion. By that measure, it is the most valuable company in the S&P 500, which limits the number of stocks that could have a material impact on its bottom line. Warren Buffett said as much in his latest shareholder letter:

There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can't. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.

In that context, Buffett's $93 billion warning takes on new meaning. The fact that Berkshire was a net seller of stocks through the first half of 2024 may say more about its size than the current market environment. That does not mean investors should throw money at the market. Valuations are indeed elevated. The S&P 500 trades at 21.4 times forward earnings, a premium to the 10-year average of 18 times forward earnings.

However, Buffett's $93 billion warning is not cause for avoiding the market, nor is it a reason to sell large amounts of stock. Instead, investors should interpret it as a reminder to carefully consider valuations when buying stocks in the current market environment.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.