This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Artificial intelligence (AI) leader Nvidia (NASDAQ: NVDA) is set to host its 2024 AI Summit starting Oct. 7. The event will bring together leaders from across the industry to see and hear from some of the foremost minds in AI. It's a chance to catch a peek at the future of this potentially revolutionary technology.

With such a big event upcoming, you might be asking yourself: Should I invest in Nvidia now? History may give us a clue. Let's take a closer look at the company.

Nvidia dominates its rivals

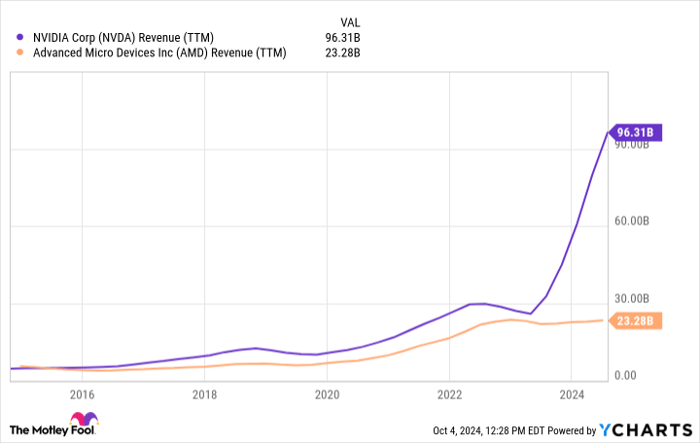

There was a time when Nvidia and its longtime rival, Advanced Micro Devices, were neck and neck in their battle to control the gaming market. By and large, there was parity between both of the company's income statements. That's changed. After AI hit an inflection point in late 2022, Nvidia is dominating AMD, earning more in profits than AMD does in total revenue. Take a look at this chart, which shows just how monumental the recent shift has been.

NVDA Revenue (TTM) data by YCharts.

That's what you get when you control 90% of a market as valuable as AI silicon. The great news for Nvidia is that it doesn't look like the gravy train will stop anytime soon. The messaging from the rest of big tech, the companies that represent most of its business, is that their spending is likely to accelerate in the near future.

This is a race of sorts, and none of the big players can afford to be left behind. As Alphabet's CEO, Sundar Pichai, put it in the company's latest earnings call: "The risk of underinvesting is dramatically greater than the risk of overinvesting for us here." Alphabet expects to spend roughly $50 billion this year in capital expenditures (capex), up from $32 billion the year before -- and it's not alone.

At present, the bulk of this spending is still flowing through Nvidia as AMD, Intel, and others struggle to match the power and efficiency of Nvidia's chips. There is still enormous demand for its current generation, and the company's next generation will likely ship within the next few months. The massive profits Nvidia has enjoyed means it has large amounts to spend on maintaining its edge. Despite already leading the pack, Nvidia outspent AMD in research and development roughly two to one last quarter.

What history has to say

This will be the third year in a row that Nvidia will host an AI event in this vein. The company began these events in 2022 with a virtual event focused on speech in AI. 2023 was supposed to be the first year of a full-fledged, multi-day AI summit, but the event was moved online for a single day. This year's event will take place in person over three days.

Despite their more modest meeting formats, both of the previous iterations led to a nice bump-up in Nvidia's stock price. In the week that followed 2022's event, shares were up as much as 10%. In 2023, they were up as much as 6.5%. So will this year's conference also lead to a jump in stock price? Maybe.

I know that might be a disappointing answer, but the truth is that we can't know for sure. First of all, two years is a very small sample size from which to draw firm conclusions. Also, even if we had more years to reference, correlation is not causation. Just because two things can be linked -- like an AI summit and a jump in stock price -- doesn't mean one happens because of the other.

But the event is a chance to remember the power that AI holds. Instead of thinking about possible short-term stock movements, focus on the company's long-term prospects. Don't lose sight of the forest for the trees. This is a company at the top of its game, enabling the adoption of a potentially revolutionary technology.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.