Only a handful of companies within the S&P/ASX 200 Index (ASX: XJO) have delivered a poorer return than the Woodside Energy Group Ltd (ASX: WDS) share price over the past year. The performance is all the more disappointing in the context of the benchmark breaking down the door of previous highs.

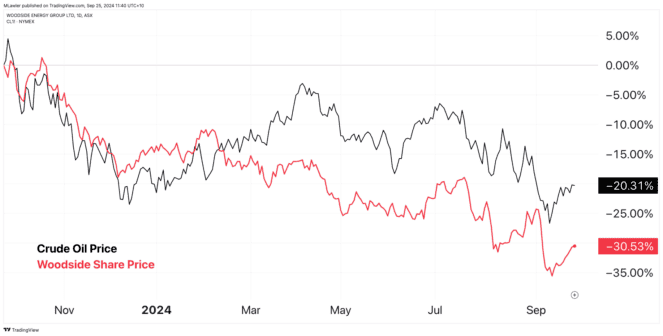

In a record 12 months for the broader ASX 200, shares in the oil and gas giant have receded 30.5% to $25.29. At least Woodside shareholders are not alone in their sorrows. The energy sector is the worst-performing of the bunch, falling 21.5% from where it was located a year earlier.

The Woodside share price needs to increase 44% to make back the last year's worth of lost ground. Is it possible? Well, a good place to start is to understand why the company's shares are in the sin bin to begin with.

Slipping on an oil slick

Energy and resource companies are often at the mercy of the underlying commodity, and Woodside shares are no different. This can work to a company's advantage when supply and demand dynamics are favourable, but it can sting when the price of a commodity is weakening.

Oil and gas prices have deteriorated despite tensions in the Middle East. The price of crude oil has tumbled 20% compared to a year ago, as shown in the chart below. And, as one would expect, the Woodside share price has taken a similar path lower.

In June, the Organisation of Petroleum Exporting Countries (OPEC) moved to postpone production cuts to next year. The announcement put pressure on oil prices, with the general view the decision only added to oversupply anxiety.

Macquarie analysts shared their opinion earlier this month, voicing a bearish tone for the next five quarters. In a note discussing the road ahead for black gold prices, Macquarie stated:

As we enter shoulder and turnaround season, the 'last hurrah' for oil in the form of Q3 tightness is quickly fading as our balances contemplate heavy oversupply across the next five quarters.

The gloomy outlook follows OPEC and the International Energy Agency reducing their own demand estimates. Both bodies cited weaker consumption out of China year-to-date for the downward revision.

Worries about what the Woodside share price can return

The softening of oil and gas prices hurts Woodside, but it cuts all energy companies the same. So why would Woodside feel the pinch any differently?

There are clouds hanging over Woodside that are being felt alone. As fellow Fool Sebastian Bowen covered yesterday, fund managers are in a huff over the company's decision-making, prompting Blackmore Capital to walk away from its stake in the energy player.

Woodside recently decided to acquire the Driftwood LNG project and the Clean Ammonia project. The two acquisitions, located in the United States, cost US$3.25 billion, which raises questions about the company's financial flexibility. Woodside shareholder Allan Gray shares this concern.

Speaking to The Australian Financial Review, chief investment officer Simon Mawhinney thinks the money could have been better allocated by conducting share buybacks.

Instead, Woodside's actions have led Mawhinney to wonder what management thinks the returns on Woodside shares are. If the targeted return on new investment is 10%, and Woodside management elects to run with it rather than buying its own shares, is the expected return from the Woodside share price "Somewhere less than 10%?" Mawhinney questioned.

Shares in the oil and gas major are flat at $25.25 apiece this afternoon.