This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

No company in the last year has captured the attention of the investing world quite like Nvidia Corp (NASDAQ: NVDA). The chipmaker dominated headlines as its stock price more than doubled since January, and with good reason; it's proven itself as one of the most important and central companies in the artificial intelligence (AI) boom — a role that has allowed it to rake in dizzying amounts of cash.

AI, if its evangelists are to be believed, has the power to completely transform the global economy, a technological revolution on par with the internet. It's important to maintain a healthy skepticism in the face of so much optimism. Promises of this scale have been made before and they haven't always turned out well for the investors involved. Still, there is reason to think this isn't a simple hype bubble. The potential is certainly self-evident. The crux is whether these companies can deliver on that promise.

Nvidia CEO Jensen Huang will join Meta Platforms Inc (NASDAQ: META) CEO Mark Zuckerberg on July 29 to discuss the future of AI at a conference dubbed SIGGRAPH 2024. Hopefully, hearing from two leaders at the forefront of AI will shed some light on developments. Whether the event itself will have a material impact on Nvidia's share price is impossible to know, but there's certainly a chance the two would announce some sort of exciting partnership. Regardless, as the event approaches, let's consider three reasons Nvidia is still a buy.

1. Nvidia is raking in mountains of cash, giving it a lot of room to maneuver

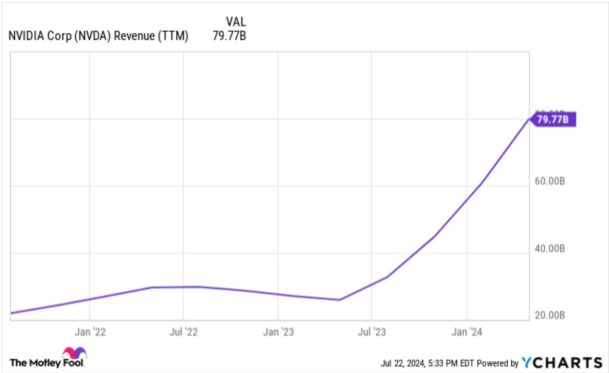

Nvidia's revenue growth over the last couple of years has been nothing short of incredible. As the AI gold rush took off, the company was selling proverbial picks to the gold miners. Except these picks cost tens of thousands of dollars. Take a look at the explosion in revenue that happened soon after AI hit the mainstream at the end of 2022.

NVDA Revenue (TTM) data by YCharts

This revenue growth is coming as the company continues to drive down costs and grow its margins. Free cash flow (FCF) is the cash a company has to play with after all expenses are paid and capital expenditures are made, and is a great measure of a company's financial health. Nvidia grew its FCF by nearly 500% in the last three years; it's now sitting just shy of $40 billion. That is a lot of cash it can use to invest in the future, defend its market share, repurchase stock, or any number of things to make the business stronger and its stock more valuable.

2. Nvidia is at the center of a $16.7 trillion market

Nvidia has the cash to help defend its market share, but even if it loses some to competitors like Advanced Micro Devices Inc (NASDAQ: AMD) — and it likely will lose some — the market itself is so big and growing so rapidly that it may not matter. PwC — one of the "big four" accounting firms — believes AI can add $15.7 trillion to the global economy by 2030. Statista.com predicts a compound annual growth rate (CAGR) for the total AI market of 28.5% through 2030. That growth that can propel Nvidia's business for years to come.

3. Nvidia may look expensive, but its price may be more reasonable if we consider future earnings

Nvidia's stock is trading at a hefty premium. The company's price-to-earnings ratio (P/E), one of the most common metrics to value a stock, sits at about 72 today. For context, Alphabet Inc (NASDAQ: GOOG) (NASDAQ: GOOGL) has a P/E of less than 30. When we look to the future, however, the picture looks a little different. Nvidia's forward P/E sits at 45, a more reasonable valuation, even if it's still on the high end. To me, Nvidia's place at the center of the AI boom and the future earnings potential that provides easily justify a premium.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.