On a scarlet-coloured day for shares, not even a quarter of growth can prevent this ASX All Ords stock from being engulfed by selling pressure.

Shares in Chrysos Corporation Ltd (ASX: C79), a precious metal assaying equipment manufacturer, are down 7.8% to $5.06 today. At the time of writing, the disappointing move ranks the company as the third-worst-performing stock inside the S&P/ASX All Ordinaries Index (ASX: XAO).

Some investors are deciding to dip on Chrysos today despite its fourth-quarter achievements.

Quarterly growth brushed aside

Here are the speedy key stats from Chrysos' fourth quarter (all figures are unaudited):

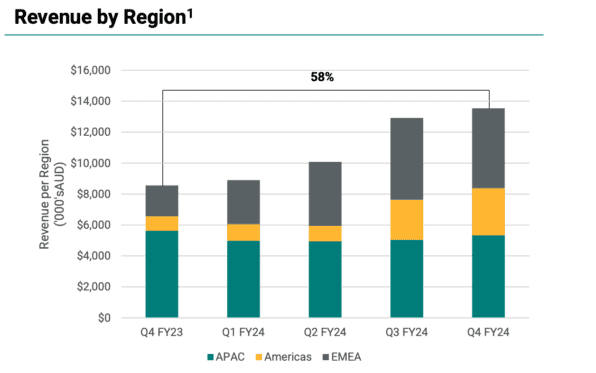

- Total revenue of $13.5 million, up 58% year-on-year

- FY24 revenue up 69% to $45.4 million

- Samples processed up 27% year-on-year to 1.2 million

- Two additional units deployed in Q4, reaching 29 deployed units

- Cash balance of $61.1 million as of 30 June 2024

Continuing to expand its installations of the PhotonAssay unit, Chrysos delivered two deployments during the fourth quarter — one in Africa and the other in Canada. At the same time, the company achieved another consecutive quarter of record sample testing volumes.

As shown in the image above, revenue across the Asia-Pacific region (APAC) was relatively flat compared to the prior corresponding period, which might be weighing down the ASX All Ords stock today.

However, the Americas and the Europe, Middle East, and Africa (EMEA) regions grew substantially year over year, further diversifying the company's revenue beyond Australia.

Working our way down from revenue, Chrysos indicated its gross margins are holding between 70% and 80%.

What's ahead for this ASX All Ords stock?

Chrysos has supplied some visibility for FY2025.

The company anticipates revenue between $60 million and $70 million in FY25. At the midpoint, this would imply an increase of 43% from today's unaudited FY24 revenue, a considerable reduction from the 69% growth prior.

Investors might be wary of slowing revenue growth when this ASX All Ords stock trades on a price-to-sales (P/S) ratio of around 13 times. Still, Chrysos CEO Dirk Treasure insists, "Chrysos' sales opportunity pipeline remains strong […]".

Furthermore, earnings before interest, taxes, depreciation, and amortisation (EBITDA) are expected to land between $9 million and $19 million in FY25.

The Chrysos share price is down 39% since the beginning of the year.