This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The Magnificent Seven stocks are some of the best and brightest growth stocks investors can buy. But many of them have amassed some incredible gains over the past year and a half, pushing their valuations to levels that are concerning for many investors.

However, electric vehicle maker Tesla Inc (NASDAQ: TSLA) has been a bit of an underperformer in 2024. Year to date, it's up only 2%, and that would have been much worse if not for a recent rally.

But in the latter half of the year, this could make for an underrated investment to hang on to, and it has the potential to be the best of the Magnificent Seven stocks to buy right now.

The company's reduced valuation could set investors up for bigger gains down the road

In 2021, Tesla hit a market cap of $1 trillion as it became one of the most valuable stocks in the world. Today, its valuation is around $800 billion. Tesla usually commands a premium, and with a reduced price tag, there could be a lot more upside for the stock in the second half of the year.

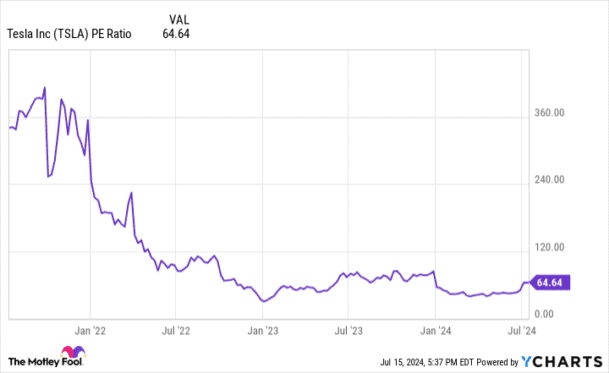

Although the stock is trading at more than 60 times earnings, that's still less of a premium than what investors have paid for the business in the past.

The company may be due for some better-than-expected quarters

One reason investors have been bearish on the stock of late is due to a weak outlook for the auto business, particularly as Chinese competitors offer cheaper-priced vehicles to compete with Tesla. But the company recently reported some encouraging delivery numbers. In the second quarter, Tesla delivered just under 444,000 vehicles, which is far higher than Wall Street estimates of 420,000.

Another potential growth catalyst is its battery business. Tesla also reported that it deployed 9.4 gigawatt hours (GWh) of its energy storage products during the quarter — a new record for the business and more than double the less-than-4.1 GWh it reported in the first quarter.

Given these strong numbers, it looks probable that Tesla's upcoming quarterly numbers could be a lot better than many investors expect them to be. And it may result in upgraded guidance as well.

Investors were underwhelmed with the company's first-quarter results this year, with sales falling by 9% year over year and profits declining by 55%. An improvement on the top and bottom lines could re-energise the stock.

Tesla's robotaxi event could be a huge catalyst

Later this year, Tesla also plans to unveil its robotaxi, a driverless taxi that could unlock yet another new growth catalyst for the company. Initially, Tesla aimed to do the unveiling in August, but it has recently pushed that back until October.

Depending on how the event goes, it has the potential to be a catalyst that generates even more bullishness and excitement surrounding Tesla's stock. The driverless vehicles can revolutionize the ride-hailing industry, and if investors see them in action and they prove to be the real deal, that could definitely light a fire under Tesla's share price in the second half.

Should you buy Tesla stock right now?

Tesla has the potential to be a top growth stock to own not just in the second half of 2024 but in the long run as well. However, there is always going to be some risk with the stock, as Tesla's financial results don't always match up to the hype surrounding its business.

But it may be a risk worth taking. The stock is trading at a reduced valuation, and a lot of bearishness is already priced into its share price.

Tesla may have a lot of potential upside, and it may be the best Magnificent Seven stock to own in the latter half of the year, as it could get a huge boost from a strong quarter, and its upcoming robotaxi event could provide the stock with yet another catalyst in the second half.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.