This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Artificial intelligence (AI), which some are hailing as the next technological revolution on par with the internet, is the investing theme of the moment.

The incredible promise of the technology led investors to lift Nvidia (NASDAQ: NVDA) stock to dizzying heights. The semiconductor powerhouse designs and sells the chips that make AI possible, putting it in a unique position in the emerging industry that led to quarter after quarter of incredible revenue growth.

So why did its CEO, Jensen Huang, sell 700,000 shares of its stock last week? Well, in short, I don't know. No one but Huang and his accountant do. What I do know is that there are plenty of reasons that don't involve him losing faith in his company. Although it's tempting to see it as a reason to run for the hills, it's really not.

Investors have to keep things in perspective. Jensen Huang owns more than 800 million shares, worth north of $100 billion, for those counting. The shares he sold last week amount to less than 0.1% of his net worth. Do you think that shows a lack of faith? Huang likely sold these shares for something as boring as paying taxes.

While it's interesting to see what a C-suite is doing with its company's stock, you can't rely on it to make decisions. Instead, always return to evaluating the business as a whole. So, is Nvidia still a good pick?

Nvidia is a cash machine. The question is, can it continue?

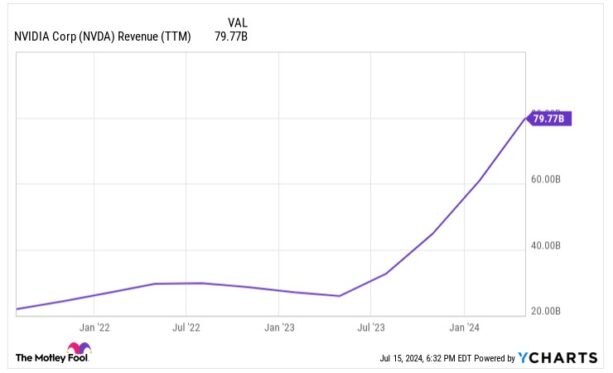

Controlling the lion's share of the AI chip market means Nvidia is printing money, growing at an incredible rate. Take a look at this chart showing the amazing growth over the last three years.

NVDA REVENUE (TTM) DATA BY YCHARTS.

It looks to be continuing as well — at least in the short term. Consensus estimates put the company's revenue at $120.6 billion this year, a nearly 98% jump from last year. That is serious growth for any company, let alone one vying for the title of the biggest company in the world by market cap.

Now, observers have to expect this to cool somewhat, but can the chipmaker still sustain strong growth moving forward? Well, there are some pretty tall hurdles to clear. The most pressing threat comes from ramped-up competition from its old rival, AMD.

This company has set its sights on grabbing some of Nvidia's pie, and although it likely will, it's a matter of how much. Thankfully for Nvidia investors, AMD is currently being outspent almost two to one by Nvidia in research and development (R&D), and it has the resources to keep it this way. I think this will allow Nvidia to stay one or two steps ahead for some time.

Nvidia's future depends on the future of AI as a whole

While plenty of challenges lie ahead for Nvidia, perhaps the biggest is whether AI itself actually delivers on its promise. Despite all the hype, there's still a lot to prove. It wouldn't be the first time a technology failed to deliver to the degree investors hoped.

Think of AI and all the businesses that enable it and benefit from it as a river. Nvidia is somewhere in the middle, upstream from the companies that deliver AI products to the end market. If those companies can't deliver AI products to the market that create immense economic benefit, they can't justify buying the hardware Nvidia produces, at least not at the same rate. In other words, the river dries up. AI has to actually deliver real value to real people — otherwise, Nvidia may have some issues.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.