This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's been a wild ride for Nvidia (NASDAQ: NVDA) investors. The stock is up 190% since this time last year as the company has positioned itself brilliantly as the dominant chip provider for the artificial intelligence (AI) market. Big tech players like Amazon, Microsoft, and Alphabet are all turning to Nvidia's technology to power their AI offerings.

The skyrocketing share price led Nvidia to split its stock 10-for-1, which it executed earlier this month. The move lowered the barrier of entry for investors, opening up the door for smaller investors and a larger portion of the retail market.

Since the split announcement, the stock is up 33%, despite the fact shares have retreated from their peak over the last week. After one of the most incredible runs in stock market history, is Nvidia still a buy?

Nvidia looks overvalued at first glance

One of the most common ways to value a company is its price-to-earnings (P/E) ratio. Nvidia boasts a P/E multiple of 70 as of this writing. Compare that to the two tech giants it's currently battling for the title of world's largest company by market capitalization, Microsoft and Apple, which have P/E ratios of 39 and 33, respectively.

Nvidia appears overvalued from this perspective, but here's the thing: the P/E ratio isn't the best metric when evaluating a company in hypergrowth mode. Despite Nvidia's already massive size, it's still growing at triple-digit rate.

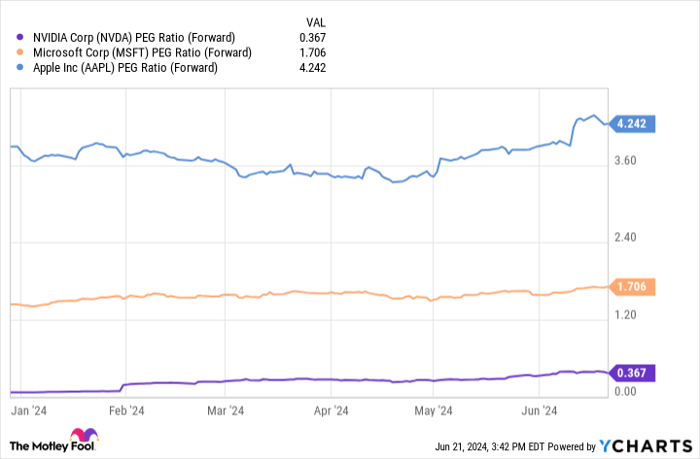

The price/earnings-to-growth ratio (PEG) can take this growth into account, and traditionally, a PEG ratio of less than 1 is considered undervalued.

Data by YCharts.

Of this trio, Nvidia is the only stock with a PEG ratio below 1, meaning its current valuation is much more reasonable than P/E alone would show. Keep in mind, though, that no single metric will give you a complete picture. The PEG ratio relies on growth forecasts, which are far from guaranteed.

So are analyst's growth predictions reasonable?

The bar is high for Nvidia, but there's ample reason to believe it can deliver

The company has already shown it can scale rapidly and grow revenue at a blinding pace. So while Wall Street's expectations are high, Nvidia's own guidance set its fiscal 2025 second-quarter revenue target at $28 billion. That's an 8% increase from the previous quarter and a 107% increase year over year. Most companies would kill to see those kinds of numbers.

These results are only possible because the demand for Nvidia's chips is still incredibly high, and the company has yet to encounter true competition.

Other companies, like AMD, are developing chips to cut into Nvidia's market share, but at the moment, they have a lot further to go. Nvidia has been one step ahead and is promising a development cycle that AMD will struggle to keep up with for several reasons, not the least of which is that it spends nearly twice as much as AMD on research and development.

The broader demand for AI that's driving Nvidia's success doesn't seem to be slowing down as PwC believes AI can add $15.7 trillion to the global economy by 2030. That means there's a long way to go until demand drops, and Nvidia stock still has room to run if it can defend its market share.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.